Loyalty Programs, Brand Values, & Data Transparency in Australia

Aussies reveal their thoughts on all things loyalty — loyalty programs, brand loyalty, shared values, zero-party data, and more.

The State of Brand Loyalty 2022

The State of Brand Loyalty 2022

Aussies reveal their thoughts on all things loyalty — loyalty programs, brand loyalty, shared values, zero-party data, and more.

Send this report to your inbox.

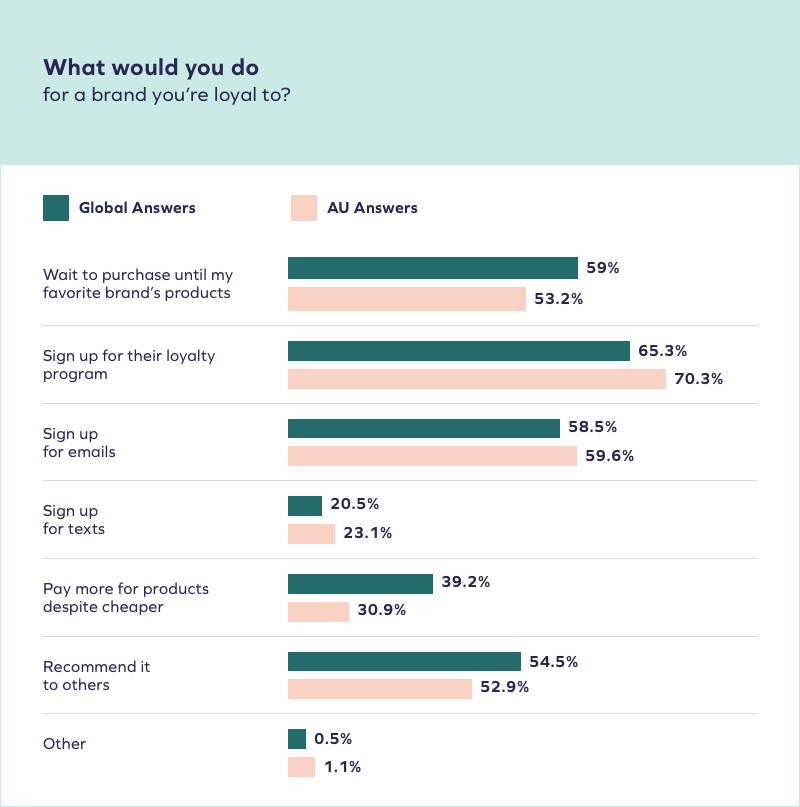

To support brands to which they are loyal, 70.3% of Australian respondents said they would sign up for a brand’s loyalty program, a 16.6% growth YoY. This number becomes even more significant when compared to global respondents’ answers:

When asked what experiences would make them feel more loyal to a brand, the overwhelming majority of Australian respondents (72.5%) said a loyalty program. Australian shoppers have said it loud and clear: Loyalty programs are a must-have in their shopping experiences.

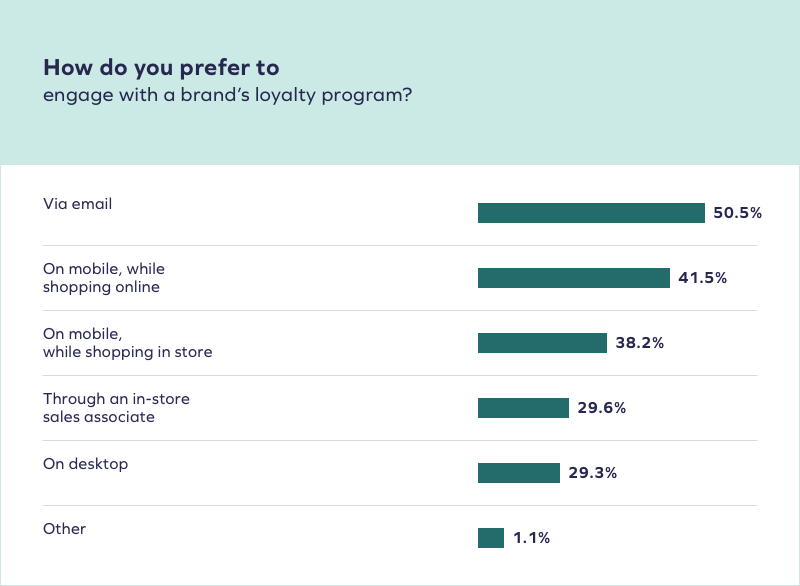

And how would Australian shoppers like to engage with a rewards program? Interestingly, over half of Aussies (50.5%) said via email, closely followed by via their mobile devices, while shopping in-store.

Hybrid shopping trends ring true for Australian shoppers. Aussies happily bounce from one channel to another regarding loyalty program engagement.

Other than discounts, Australian shoppers want early access to sales, gifts or swag, and early access to new products as their reward options.

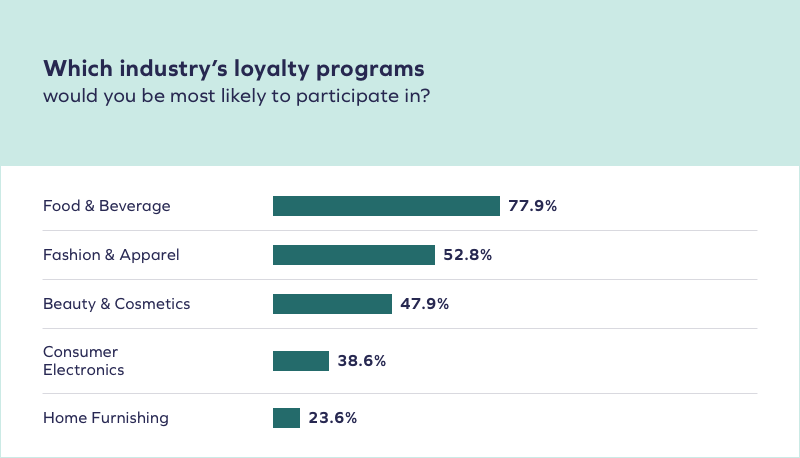

While some brands may think a loyalty program doesn’t suit their industry, Australian shoppers disproved this myth. Almost 80% of Aussies (77.9%) said they would most likely participate in a loyalty program offered by a Food & Beverage brand, with a mostly even split across other industries.

Compared to other countries surveyed, Australian shoppers are less likely to shop from Amazon to support brands to which they are loyal. In fact, only 14.3% of Australian shoppers prefer to shop from the eCommerce giant. Instead, 63.4% of respondents said they favored shopping from the brand’s site directly.

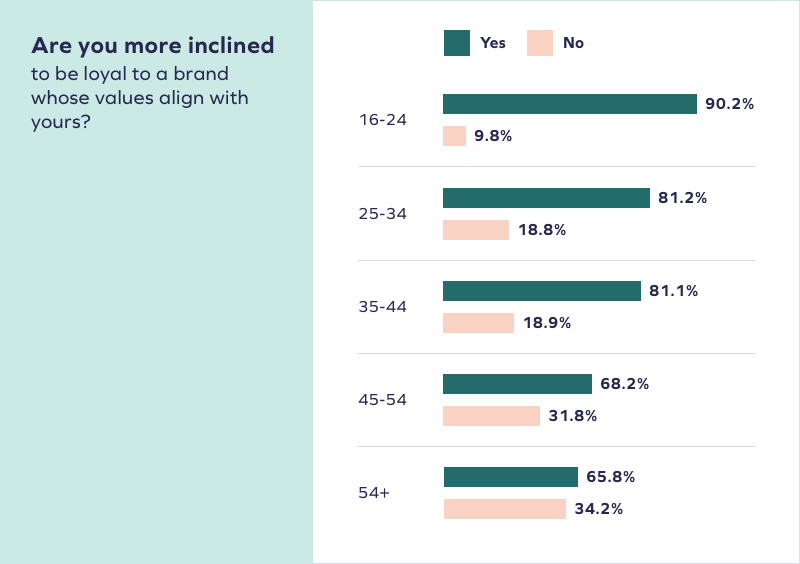

74.9% of Australian respondents said they are more inclined to be loyal to a brand whose values align with their own, compared to 80.2% of global respondents. However, year over year, Aussies did see a slight drop in the importance of brand values — 7.3%, to be exact. Yet, Gen Z remained steadfast in their beliefs. Over 90% of Gen Z Australian respondents buy based on brand values versus 72.2% of other age groups.

Like global respondents, how brands use customer data matters to Aussies. The majority of Australian respondents (71.7%) said data transparency was important. Aussies want to know exactly how their data is used by brands — what’s collected, for what purpose, and to what end.

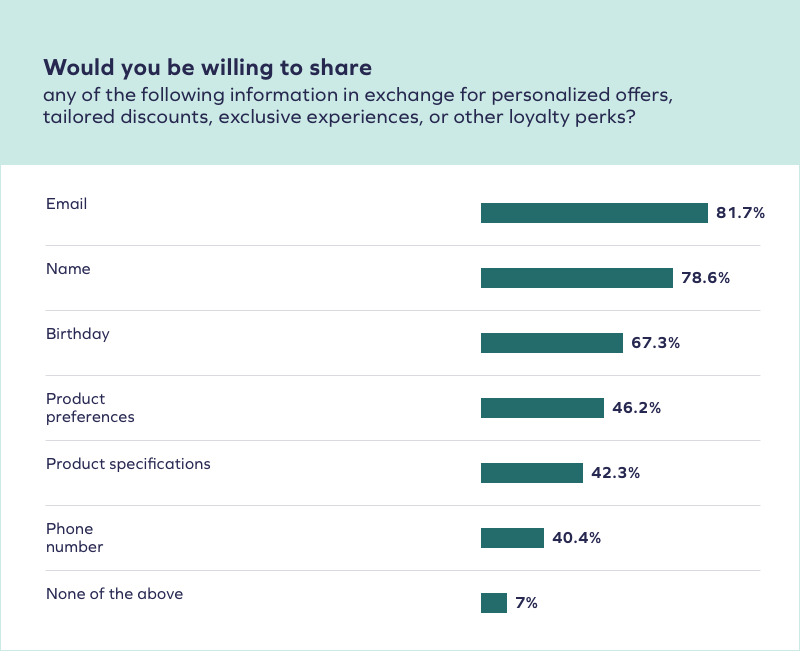

However, almost 60% of respondents said they’d willingly share personal information in exchange for loyalty rewards, points, discounts, and/or personalized loyalty experiences.

This data included:

Aussies want to share their data with the brands they love, but only if there’s something in it for them. Loyalty programs offer Australian shoppers measurable value for their personal information — better, more relevant experiences being just one example.