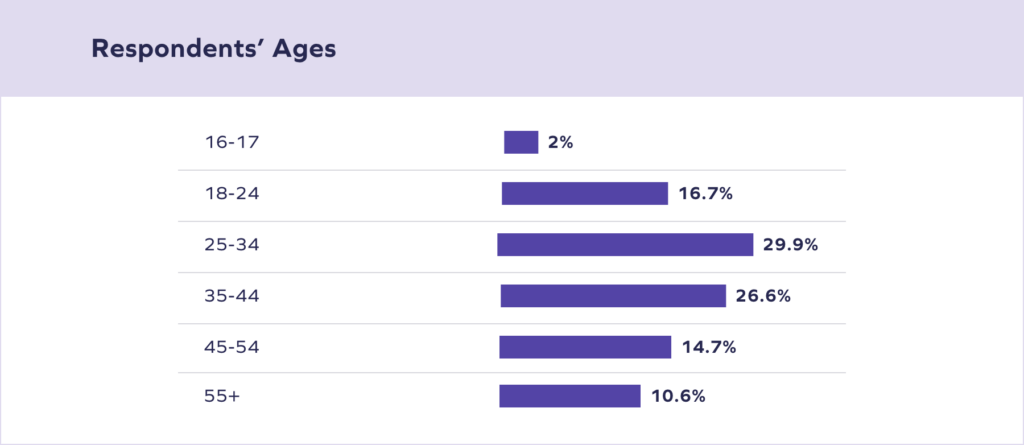

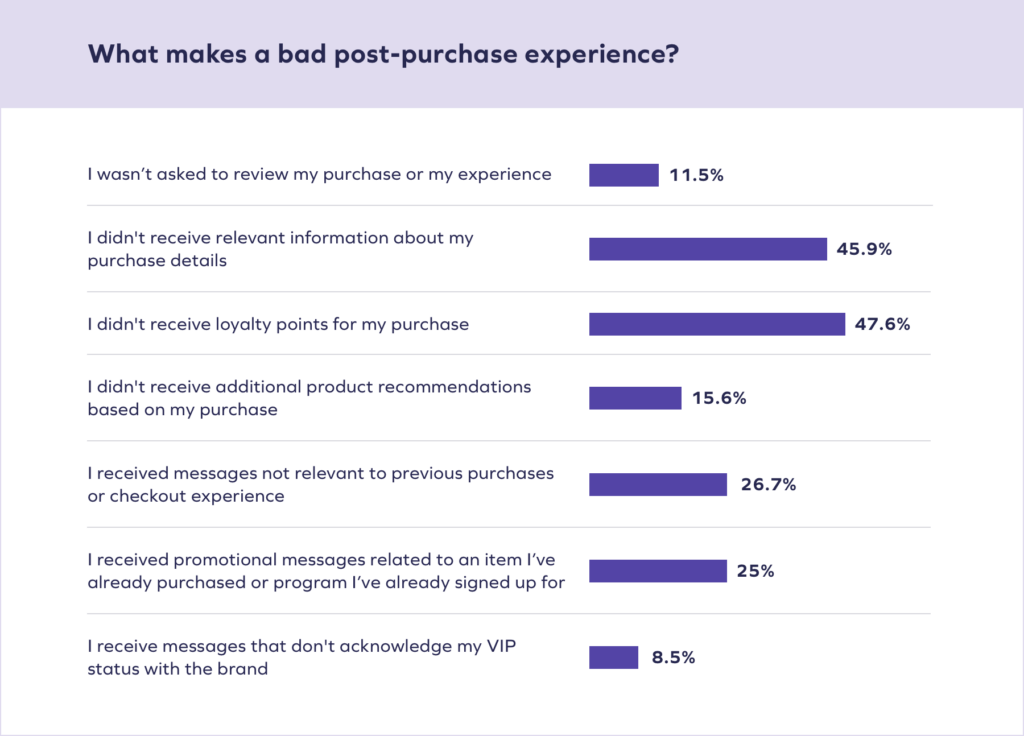

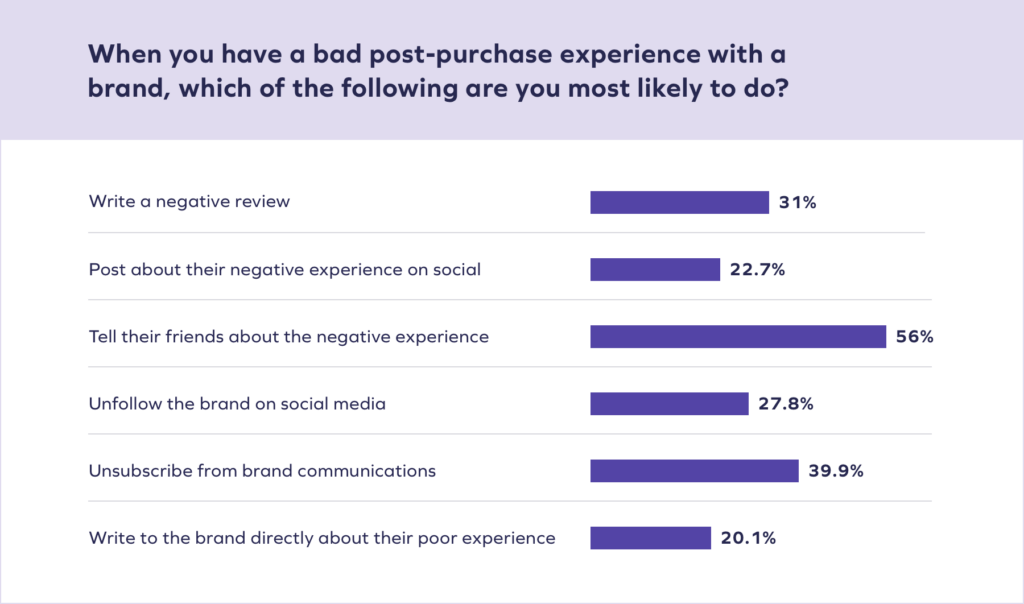

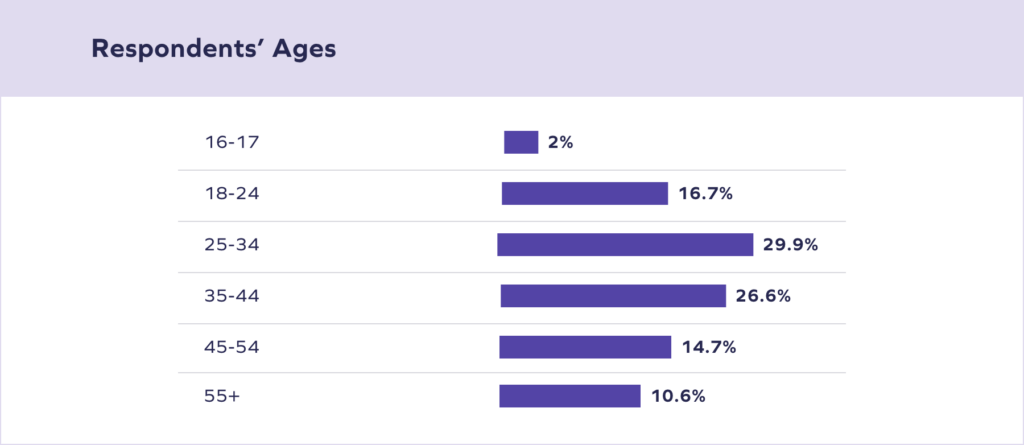

In December 2022, Yotpo surveyed 1,266 consumers from the United Kingdom on all things customer loyalty and retention — what made an excellent post-purchase experience, what keeps customers loyal, how customers expect to be treated in exchange for their continued business.

These shoppers spanned six age groups (16-17, 18-24, 25-34, 35-44, 45-54, and 54+) and four generations (Gen Z, Millennials, Gen X, and Baby Boomers).

As you’re probably feeling, our macroeconomic environment has been tenuous, to say the least. Since late 2021, the UK has been experiencing a cost of living crisis as disposable incomes account for less and less. Inflation seems to have peaked around 13% in late 2022, but we’ve seen a definitive slowdown in consumer spending as recession worries continue to loom.

Where does this leave customer loyalty?

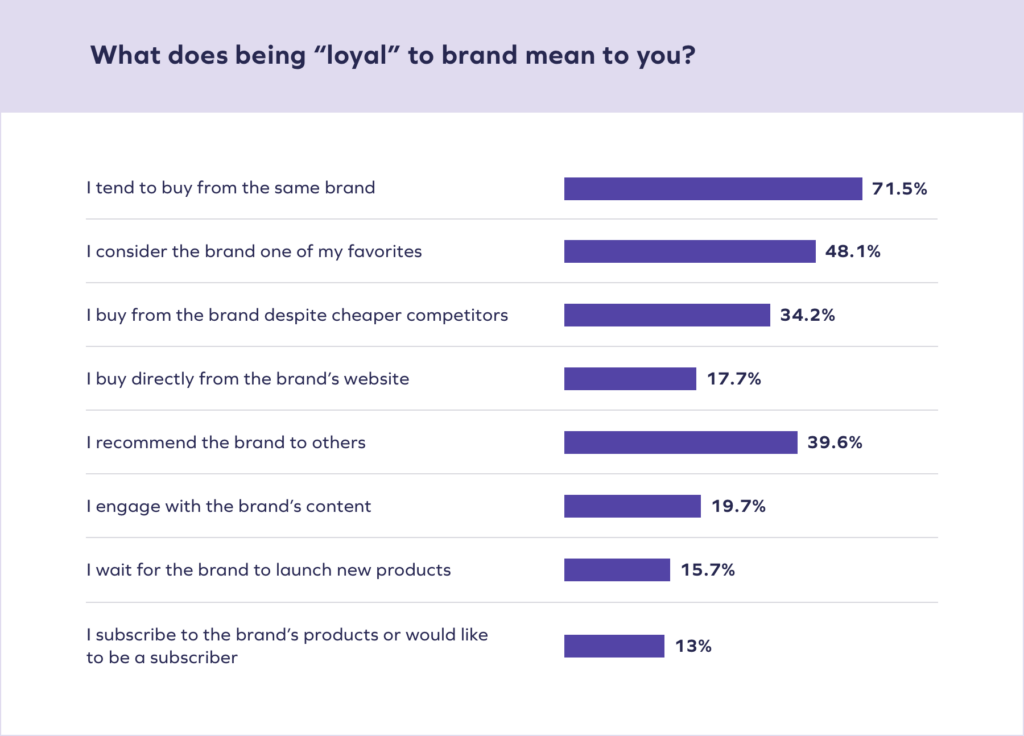

Last year, the state of UK brand loyalty was directly tied to customers’ emotions and values. Shoppers wanted to feel seen and recognised by the brands they love. They also championed brands with similar beliefs as their own. In exchange for their loyalty and repeat business, UK shoppers wanted a relationship with brands that surpassed the checkout page.

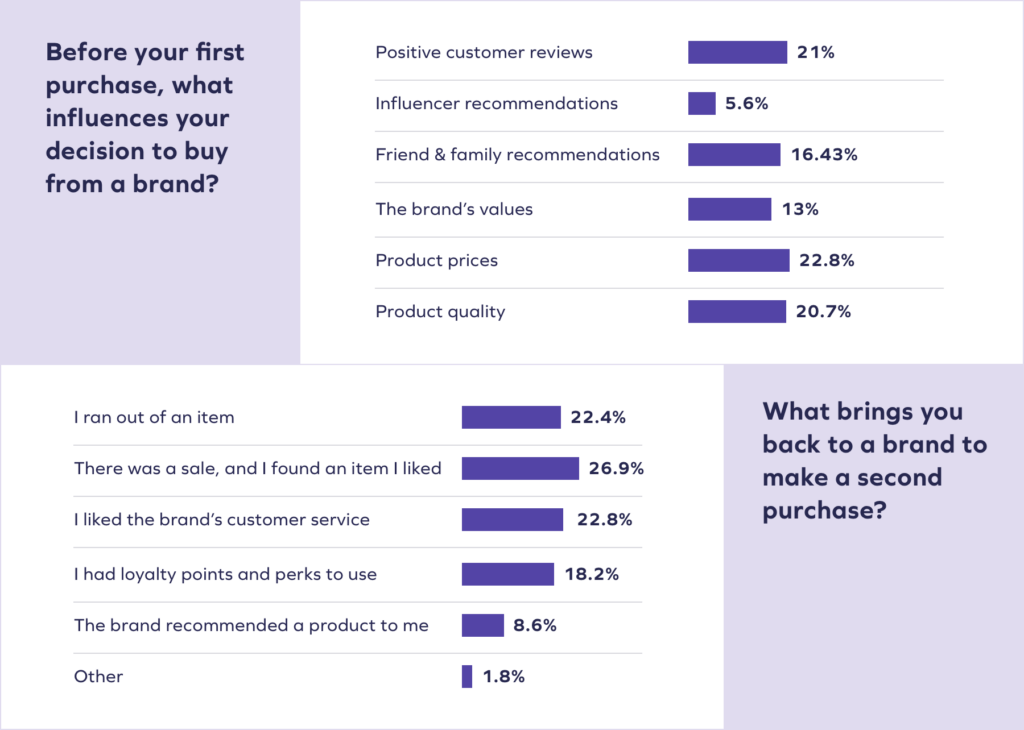

This year, with price and product quality on everyone’s minds, UK consumers expect that much more from brands. If you’ve gotten customers’ attention this year, congratulations. Now you have to figure out how to keep it.

Getting retention right in 2023

While our macroeconomic environment has changed, impacting customers’ sensitivity to price and value, there are strategies that motivate UK shoppers to stay loyal to brands.

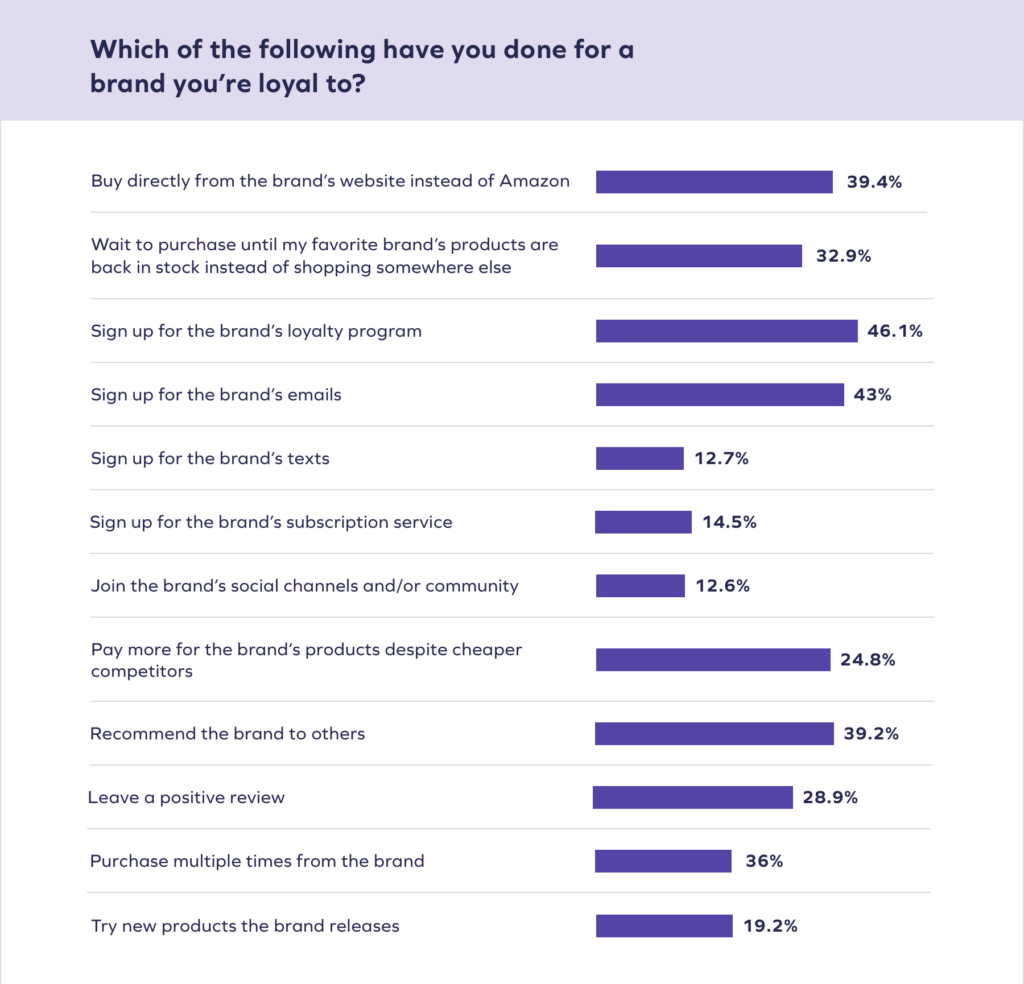

Customer loyalty isn’t set for life. Every time the economy shifts, on a micro or a macro level, customers’ loyalty to your brand is being questioned and challenged. It needs to be earned over and over again. It’s why retention is so much more multidimensional than acquisition; retention demands you treat first-time, two-time, repeat, and loyal shoppers with nuance. And, the margin of error is that much smaller.

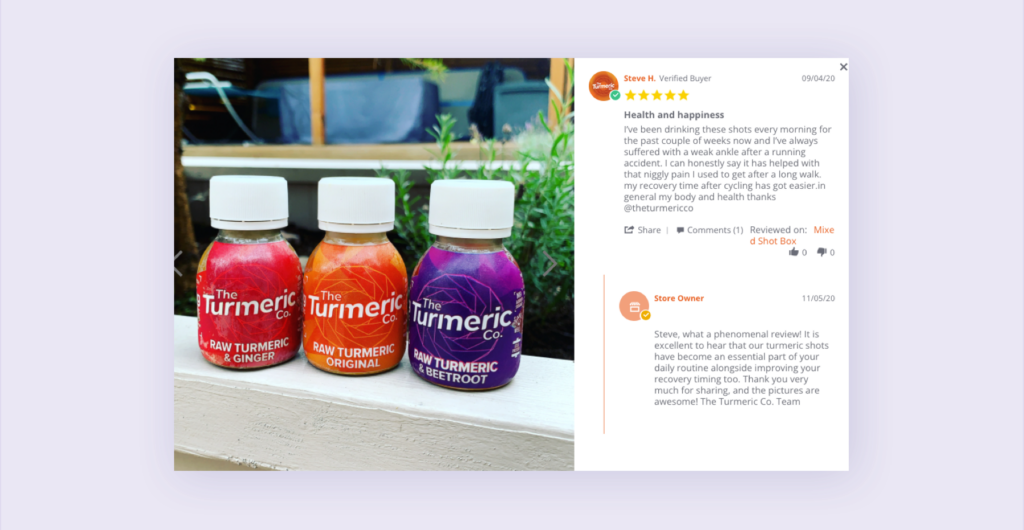

Successful customer retention for UK brands means crafting exceptional post-purchase experiences, communicating effectively, offering worthwhile loyalty experiences, and knowing shoppers to their core.