With the cost of living crisis affecting many Australian shoppers’ day-to-day, price sensitivity is on the up and up. Customers are considering the value of every purchase, meaning brand loyalties are shifting. It now takes more for Australian shoppers to stay loyal and less for them to walk away.

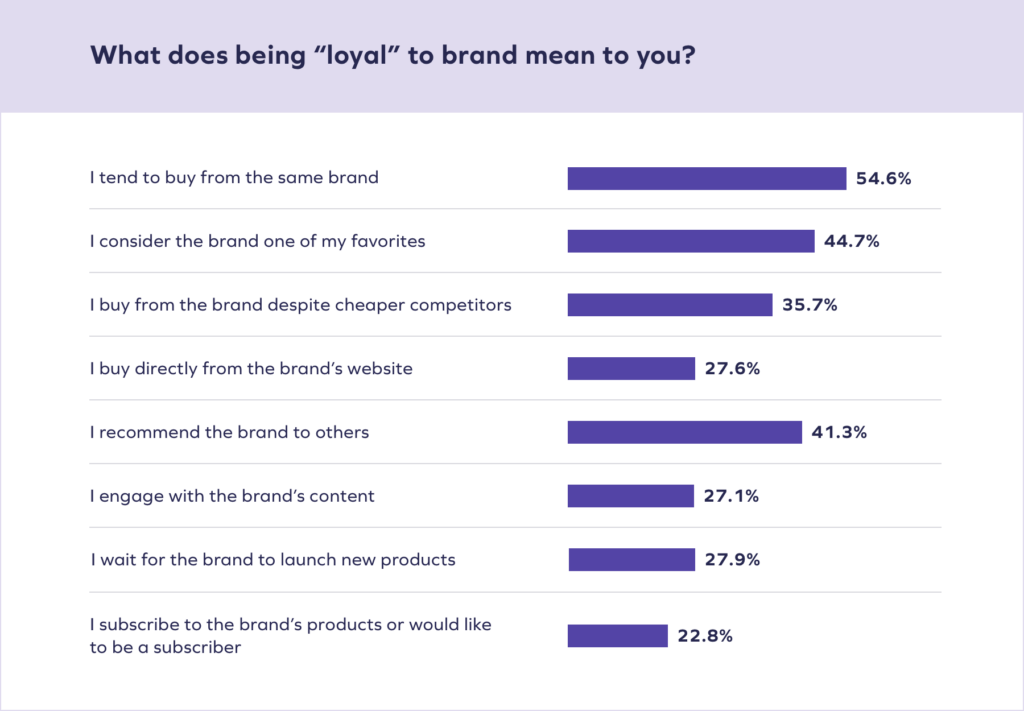

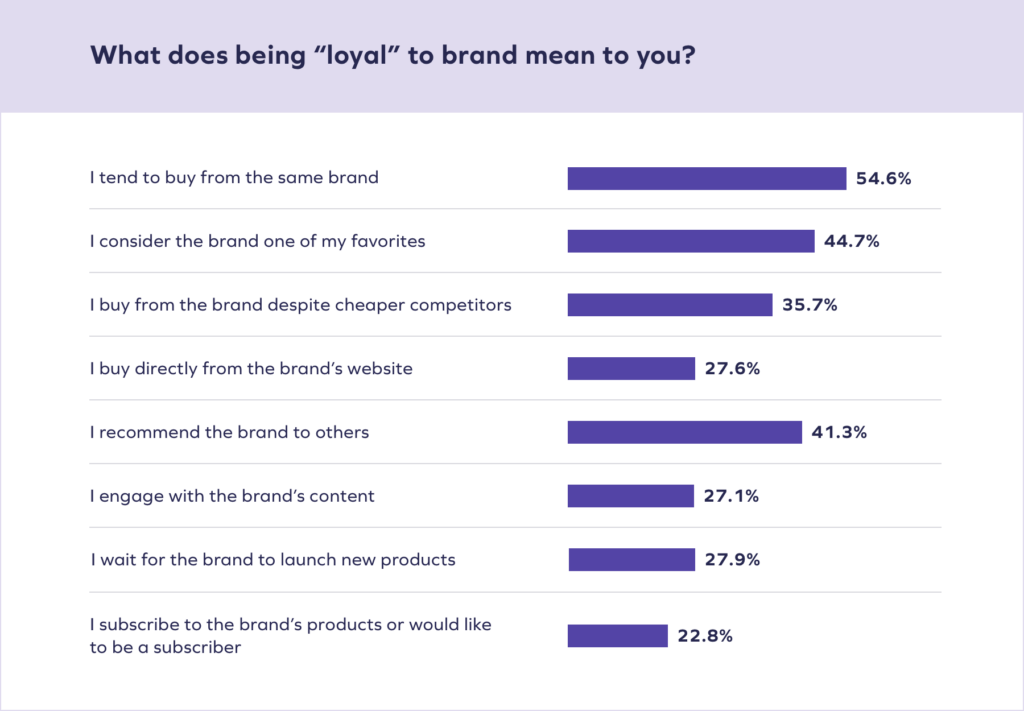

When asked how they define what being “loyal” to a brand means, 54.7% of Aussie shoppers said “I tend to buy from the same brand,” a decrease compared to past years’ surveys. It’s no secret that everyone is feeling the effects of price hikes. Everyday essentials like utilities, basic groceries, and rent have increased significantly in the past 12 months.

While this sounds bad for brands, all hope is not lost. Now more than ever, clearcut retention and loyalty strategies are vital for brands of the next decade. Customer loyalty is not gone altogether; it just comes with higher expectations. Aussies aren’t just going to give away their repeat business for free. Instead, they want real value in return.

When buying from a brand for the first time, 19% of Australian answers said they are influenced by product prices, followed by positive customer reviews (18.8%) and product quality (18.8%).

When buying for the second time, 31.2% of Australian answers denoted their second purchase was due to finding an item they liked during a sale. On the surface, this feels like another discounting strategy. Oh, a sale! But, underneath, this second purchase had to start with making the customer aware of the products pertinent to them. Via text, email, on-site banner, or social media: The brand needed to create relevant, personalized communications for these customers to come back. Discount fatigue in today’s climate is real, and customers need to feel confident in their purchasing decisions. Smart brands will commit to a new strategy — prioritizing focused communications that rise above the noise to both capture attention and increase customer retention.

Additionally, over 20% of answers said rather than a price drop, a brand’s customer service brought them back to buy again.

Price is important, now more than ever. But brands cannot overlook providing an exceptional customer experience during hard economic times.