Why Google Shopping is a Compelling Opportunity for Brands

In this lesson, we’ll get expert advice for using Google Shopping to grow your brand, and what you need to know to measure your ROI for the channel.

Google Shopping Guide

Google Shopping Guide

In this lesson, we’ll get expert advice for using Google Shopping to grow your brand, and what you need to know to measure your ROI for the channel.

Get even more from Google Shopping with Yotpo's official integration.

Google Shopping has become a key channel for our clients at Vervaunt. On average, about 60 to 75% of our clients’ ad spend goes through Google Shopping. This investment is yielding big results, as Shopping is typically one of the most cost-efficient channels to drive net new customer acquisition.

This major opportunity has led to steep competition, with two main factors now shaping the landscape:

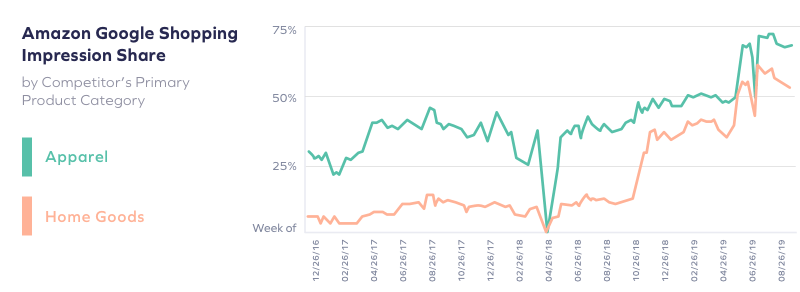

Amazon’s impression share year-over-year has doubled. We see them competing with almost all of our clients, regardless of industry — even in luxury, where Amazon typically has a weaker offering. This increasing competition will drive up costs and CPCs within the auction, while challenging retailers to find opportunities to compete.

Brands of all sizes can now use Google Shopping because automated feed technology has become scalable and accessible. There are APIs from Shopify and Magento to the Merchant Center to facilitate the Google Shopping set-up, and the introduction of Smart Shopping is providing retailers with easy access and simple day-to-day management.

From 2014 to today, Google Shopping has risen to hold the majority of Google Paid Search clicks within US retail. While it accounted for less than 30% in 2014, it’s now at 62%.

The market share of Google Shopping is most significant for non-brand retail searches, such as when users search for “t-shirt” rather than “H&M t-shirt.” For these non-brand queries, Google Shopping Ads now account for 88% of paid search clicks.

With Google Shopping, as opposed to text ads, brands bid at a product level, and cannot dictate the searches they appear on. For example, the bid amount is the same for “sneakers” as it is for “Nike Air Max sneakers.”

This means that in general, you should bid higher, for a more specific term, which is the most likely to convert the most often.

By using priority settings and negative keywords, you can indirectly filter search terms into specific campaigns where you adjust the bids, such as branded and non-branded queries. To take it to the next level, you can use scripts to automatically add in negative keywords if they are triggering your ads, so long as they’re not in a list of pre-defined terms you want to appear on, and aren’t driving performance.

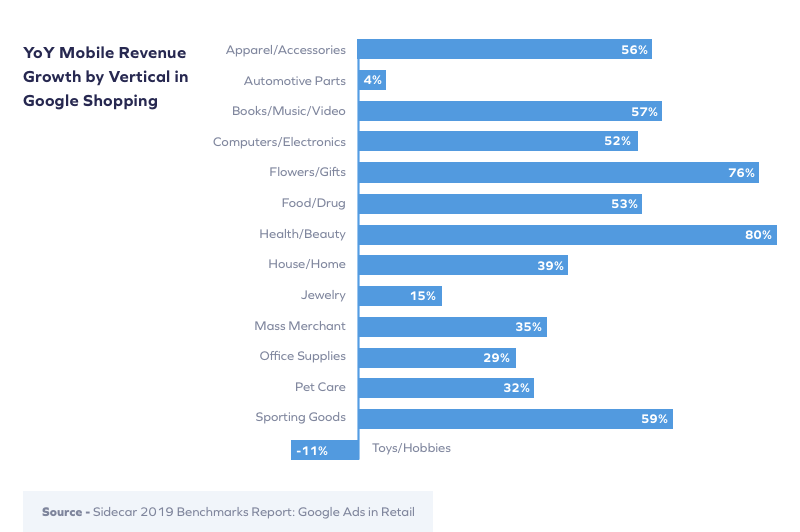

As we drill down into the numbers, we see that Google Shopping growth is underpinned by these two trends:

When it comes to Google Shopping, it’s easy to assume that spending more of your budget would yield even better results. The reality isn’t so clear cut.

If brands were to double their shopping spend, they would only drive around 50% more traffic. Instead, you need to carefully monitor your impression share and bid simulator tool to understand how much more value you can drive with additional spend.

In addition to the exponentially increasing costs, there’s also a diminishing returns curve. Generally, you can maximize coverage on branded and lower-funnel queries, which typically convert well. Then, as you expand to broader queries, your conversion rate will drop, and as you spend more, you’ll be challenged to maintain ROI. For these reasons, it remains important for retailers to implement a diversified marketing program across the major channels.