Sometimes as a brand we get caught up in the experience we’re trying to create, our grand vision, and in doing so we overlook what our customers want, what they prefer. Henry Ford said, “It is the customer who pays the wages.”

It’s so important with the continuous focus on customer experience and customization that we, as marketers, keep that fact at the front of our minds as we’re building our subscription businesses. We have a limited amount of time to “get it right” and if we don’t meet subscribers’ needs right out of the gate they could be a lost customer.

Let’s dive into your shoppers’ preferences and unpack the what, where, and why behind their shopping behaviors.

Peeking at Preferences: The Kinds of Subscriptions Shoppers Want

When we asked shoppers what kinds of subscriptions they preferred, more than half of the respondents said they wanted refills for their everyday products. This solidifies the idea that shoppers know which items they’ll need again in the future and likely have a good grasp on how often they run out of said items. Flexible order frequencies are great for these kinds of customers.

Less than 25% of shoppers are looking for surprise boxes and even fewer want to spend time customizing a monthly subscription. Brands offering subscriptions should take a step back and consider how they’re meeting these needs.

This can feel tricky for brands that don’t feel like they fall into the refill category of subscriptions, for example maybe you sell candles or even beauty products, but all is not lost. Education with a focus on product usage can help your customers feel more satisfied with their subscriptions.

In general, marketing is essential if your products aren’t clear everyday items but still fit the subscription mold. You may need to work a little harder convincing your customers a subscription is still the right move, even if the product isn’t something as essential as say toilet paper. This is where tying your subscription to a loyalty program can help educate your customers on usage and incentivize them with tiered rewards.

The What, Where, and Why of Subscription Preferences

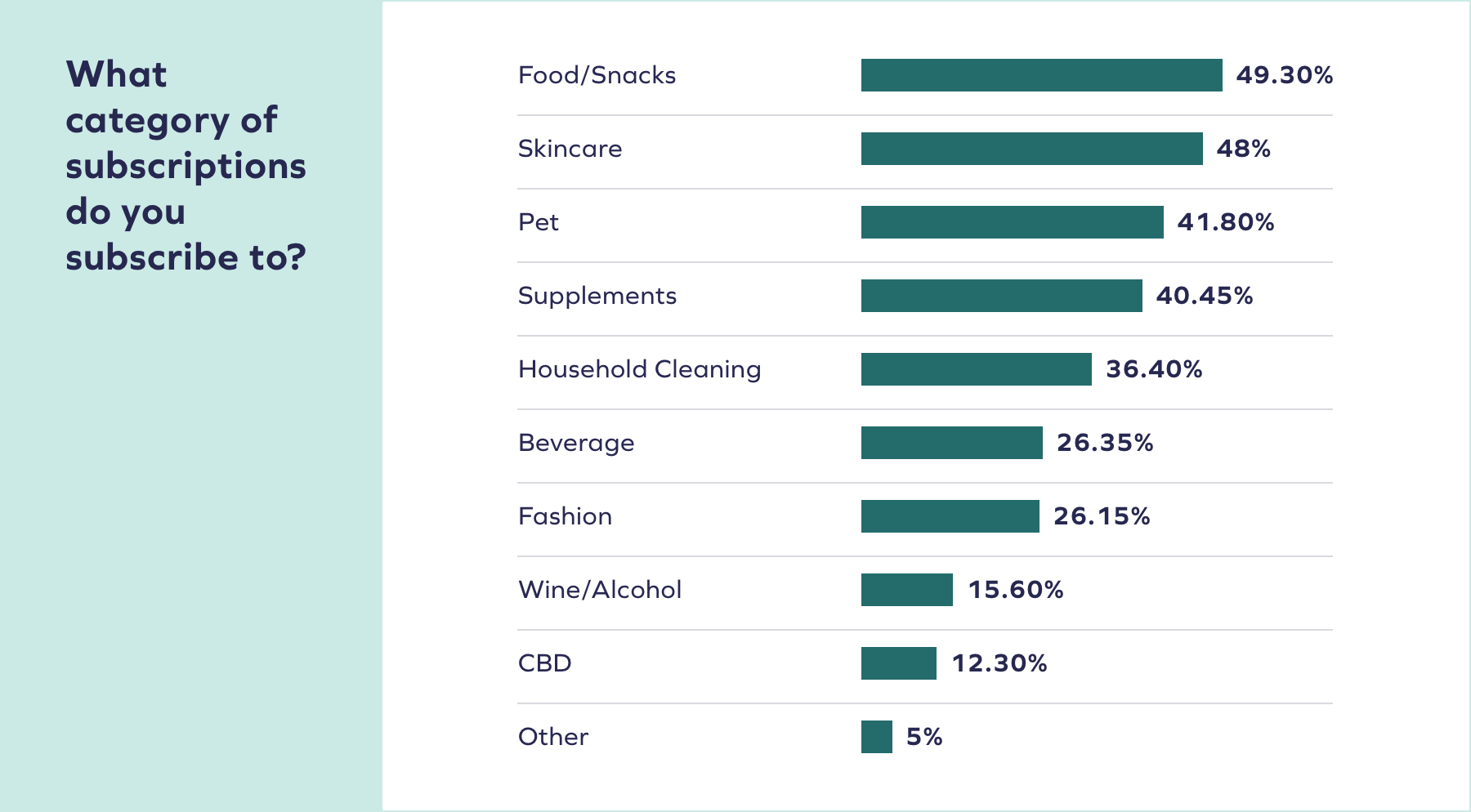

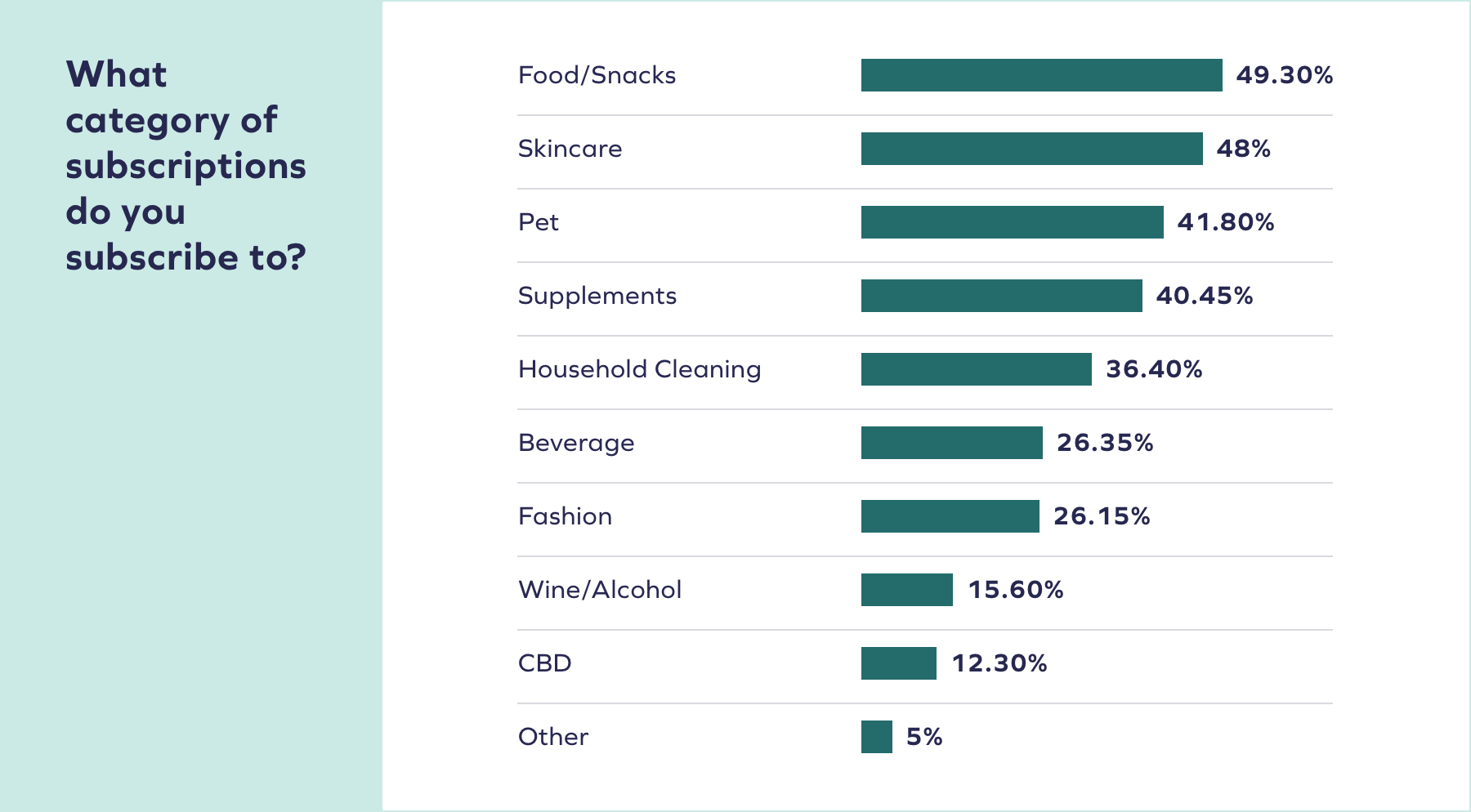

When we asked consumers to select what categories of subscriptions they subscribe to, almost 50% of respondents selected food/snacks. Another 48% went to skincare, 42% of respondents subscribe to pet supplies, and 40% have a subscription to supplements.

What do all of these categories have in common? They’re all consumables, and they need to be refilled at regular intervals.

Digging deeper into the data we can see:

- 54% of females surveyed subscribe to skincare products

- 52% of male respondents subscribe to food/snacks.

Where the data differs is with shoppers over 54. In our survey, the older generation preferred to subscribe to supplements and pet supplies.

- 46% of males subscribe to supplements

- 46% of females over 54 subscribe to pet supplies.

What can brands do with this information? Having a clear understanding of your customer personas is vital to keeping them subscribed for longer. It helps you understand exactly who they are and what they’re looking for. Just don’t fall into the “grand vision” trap. As a brand, we have an idea of who we want as our core customers, but that isn’t always the reality. Finding your product-market fit and then leaning in can help you figure out where your customer is.

So let’s talk about why having a clear understanding of shoppers’ subscription preferences is the best thing you can do for your subscription channel. Spoiler alert, it boils down to opportunity.

Of the shoppers we surveyed, 40% are looking for a subscription from brands they know and love. That’s a whole lot of opportunity.

- 14% are looking for more subscription options for personal hygiene products

- 12% want more options for grocery subscriptions

- 8% would like to see more apparel subscriptions

- 6% are looking for more household cleaning supply subscriptions

One of our survey respondents states, “I wish there was a kitchen refill subscription: garbage bags, dish rags, sponges, ziplock bags, etc.”

So while the subscription economy feels a little saturated, clearly there are customers out there who feel like their needs are still not being met. With this in mind, let’s look at what makes for a good subscription from the lens of our customers.

What makes for a good subscription?

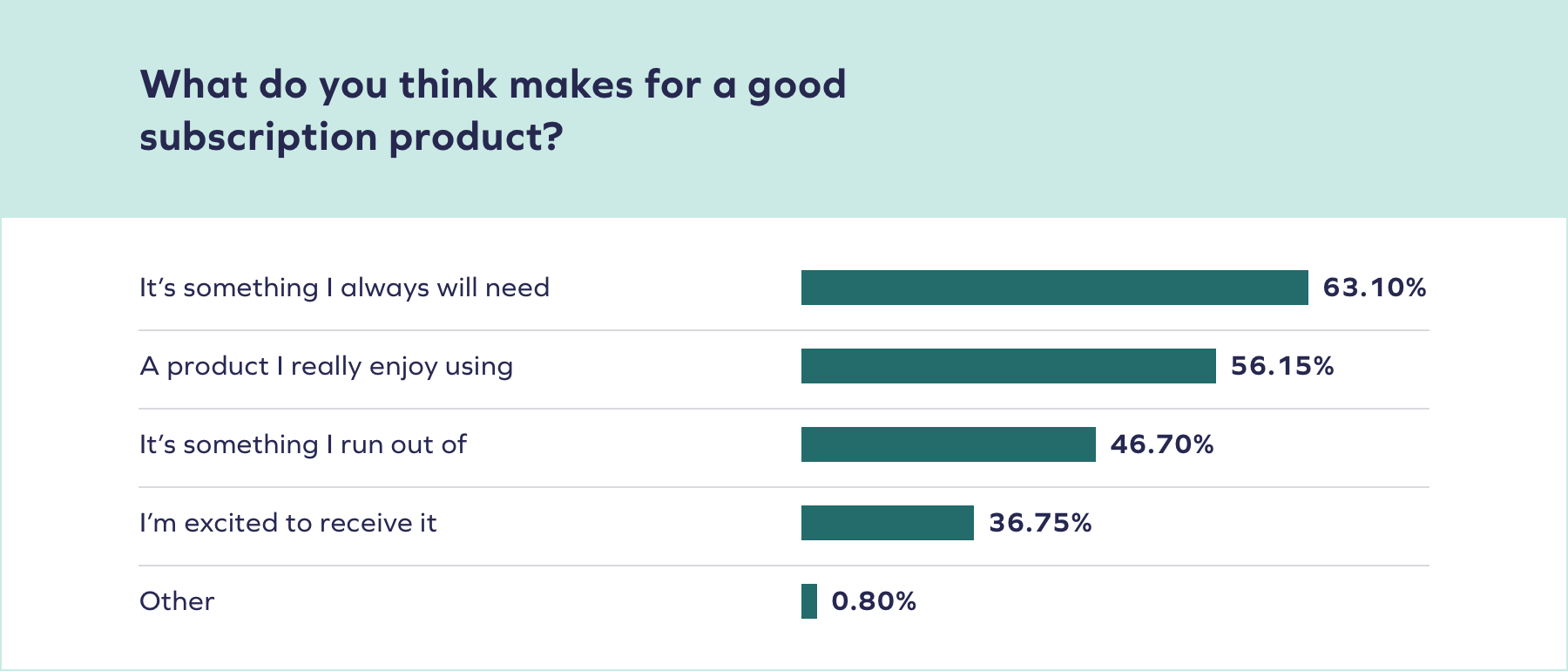

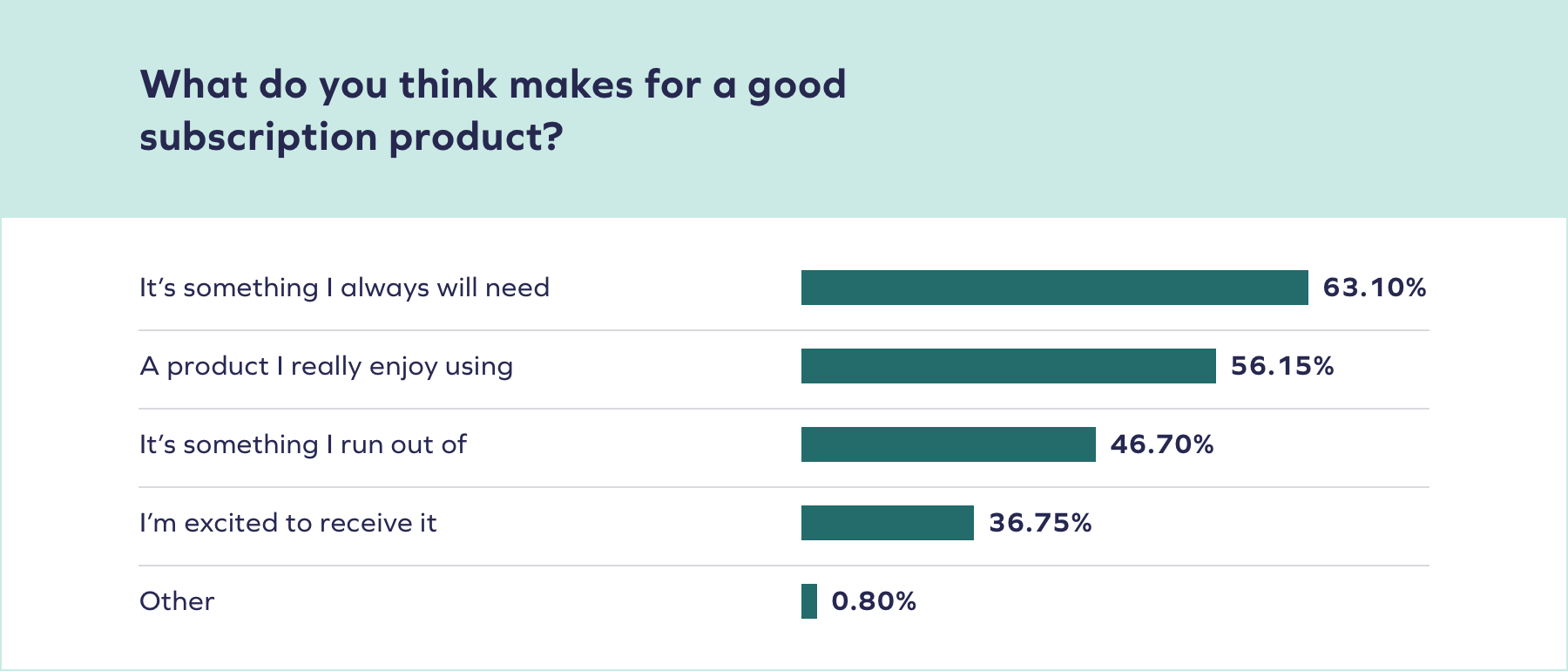

We wanted to get a better understanding of what shoppers considered a good subscription. We asked survey respondents to select what they thought made for a good subscription product, 63% said it’s something they will always need, like toilet paper or pet food. 56% said it’s a product they really enjoy using and 47% said it’s something they run out of.

So while the customer may be in charge of deciding what kinds of products they need regularly, the brand has total control when it comes to the enjoyment factor. It’s not just the quality of the product, though that is so important, it’s the content, the packaging, the unboxing experience, and the communication between you and the customer; it all plays a part in the broader customer experience. The true formula for a long-lasting subscriber is need + enjoyment, and the data proves that.

What can you do as a brand to strengthen the need and enjoyment factor? Focus on usage and education. Being able to show your customers the value in regular usage of your product turns it from a “nice to have” into a “need to have”. This approach can also help defend from churn.

Need + Enjoyment IRL

Vitamin and supplement company, Olly uses a surprise and delight tactic with their subscribers. The brand creates unique swag and sends it to its customers. It’s not on a regular schedule so subscribers never know when it’s coming. It’s a great way to surprise customers and let them know you’re thinking of them.

Kids protein company, Healthy Heights likes to create recipe postcards and add them to their subscriber’s orders. This is a great way to show subscribers different ways they can use the product, keeping them engaged with the brand.

Now that we’ve examined what your shoppers prefer when it comes to their subscriptions, let’s dive into their expectations.