As we shift to a new era in the Covid-19 pandemic, our team found ourselves looking back on the experiences we’ve had. As both consumers and marketers, we’ve changed.

As consumers, we changed our personal buying habits to start primarily online shopping. We chose new brands that met needs we didn’t know we had, we sought out brands whose values aligned with our own, and we became loyal to products we hadn’t expected to need. Bet you never thought you’d have a favorite cloth face mask brand, right?

Throughout these uncertain times, one common thread held strong: eCommerce is essential. According to Oberlo, there were over 2.05 billion active online shoppers in 2020. Compared to $3.53 trillion worth of eCommerce transactions in 2019, there were more than $4.2 trillion in 2020.

That’s a whole lot of online shopping.

So, what were people buying all this time? We chatted with our customer success team and dove into Google Trends to see what unofficial, U.S.-based shopping tendencies we could uncover.

The early days of the pandemic

Clorox wipes

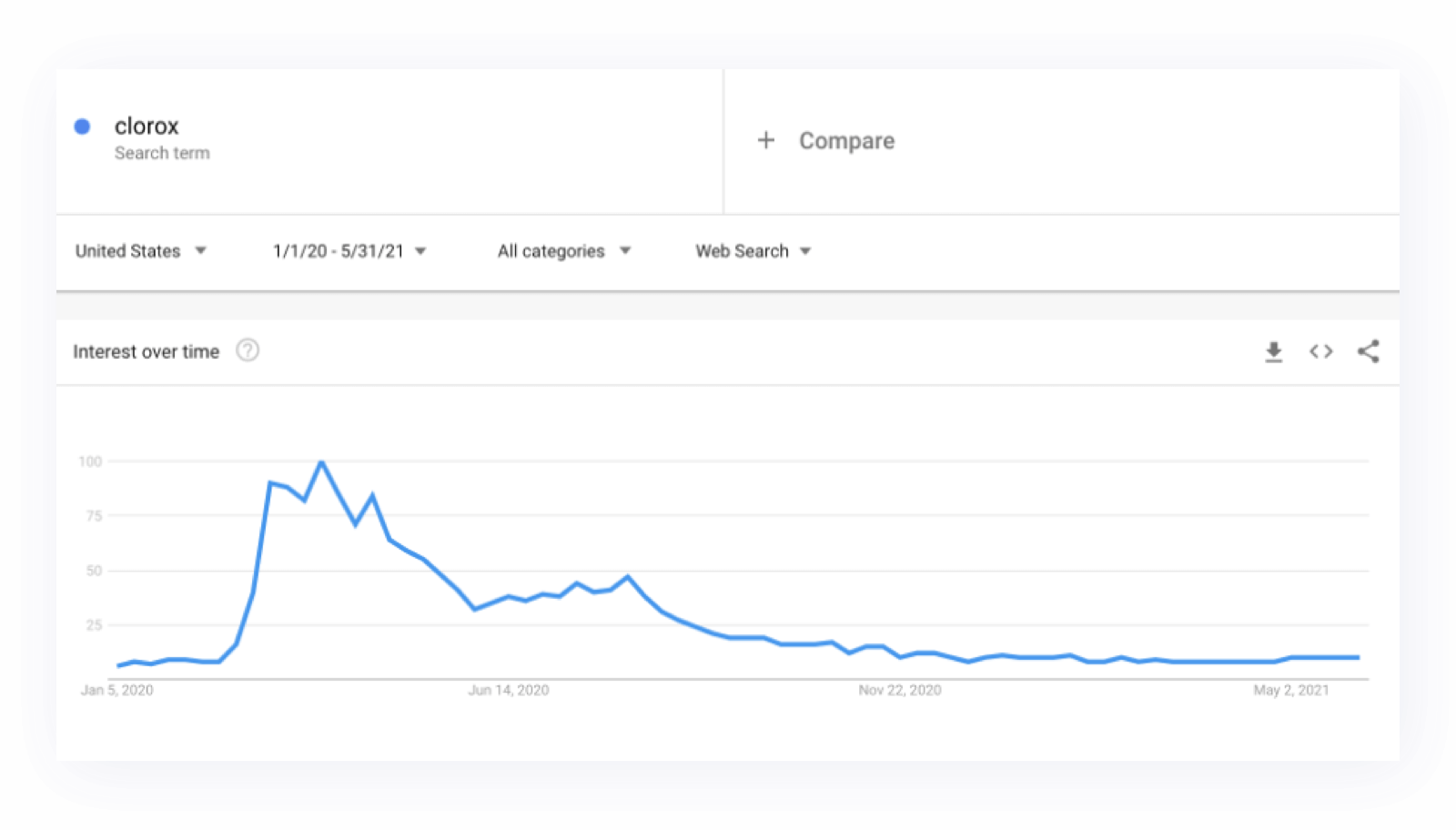

We’ll begin with the obvious. At the beginning of the pandemic, when murmurs of the threat of Covid-19 were beginning to make themselves heard, consumers were quietly starting to prepare. Stockpiling Clorox products, including wipes, sprays, bleaches, and more, started hitting its stride in February, and it continued for a few months until availability became more reliable (and the reality of the longevity of the situation set in).

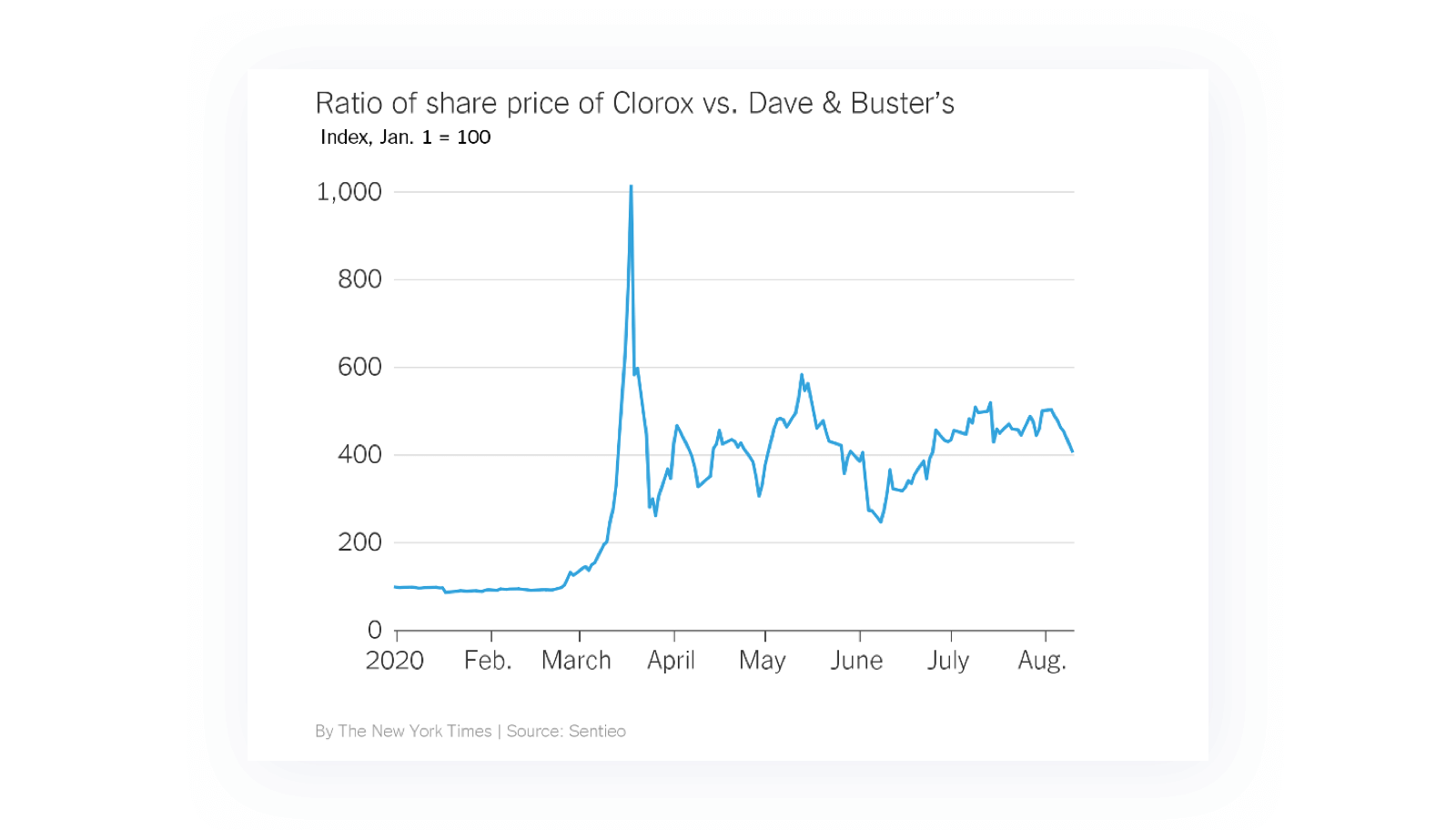

Interestingly, see here the share price ratio of Clorox to Dave & Buster’s, courtesy of Sentieo. Consumers were far more concerned about the demand for disinfectants rather than the desire to gather indoors to play games. According to the research, “the more that Clorox gained in value versus Dave & Buster’s, the more concern there was about the virus.”

Source: NY Times

Sourdough starters

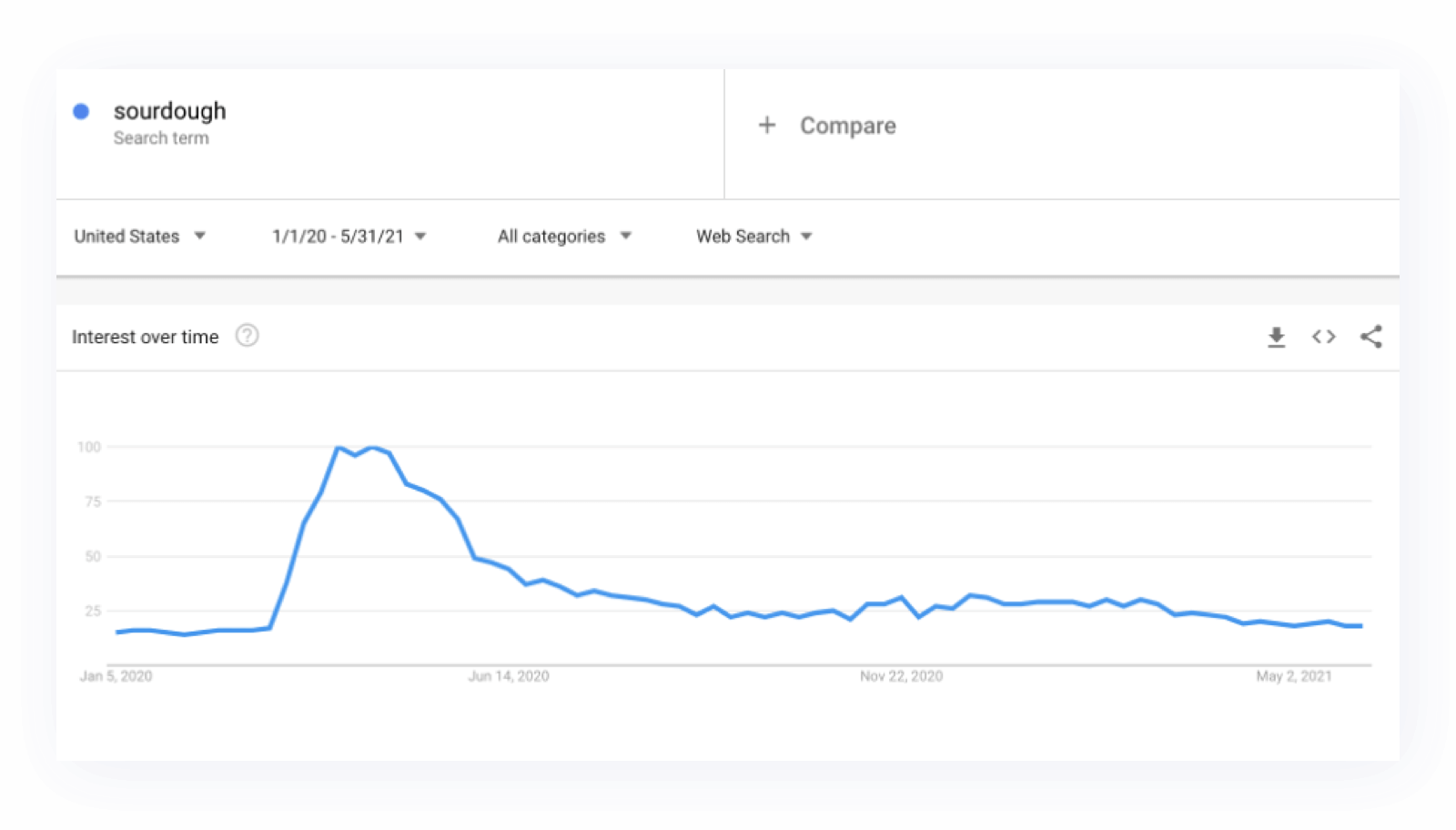

Remember when all your friends on Instagram suddenly started baking bread in March 2020? Well, they were in widespread company. “Sourdough” shot up in search — including related queries, like “how to start sourdough,” “how to start sourdough starter,” “wheat flour,” and “rye flour.”

Face masks

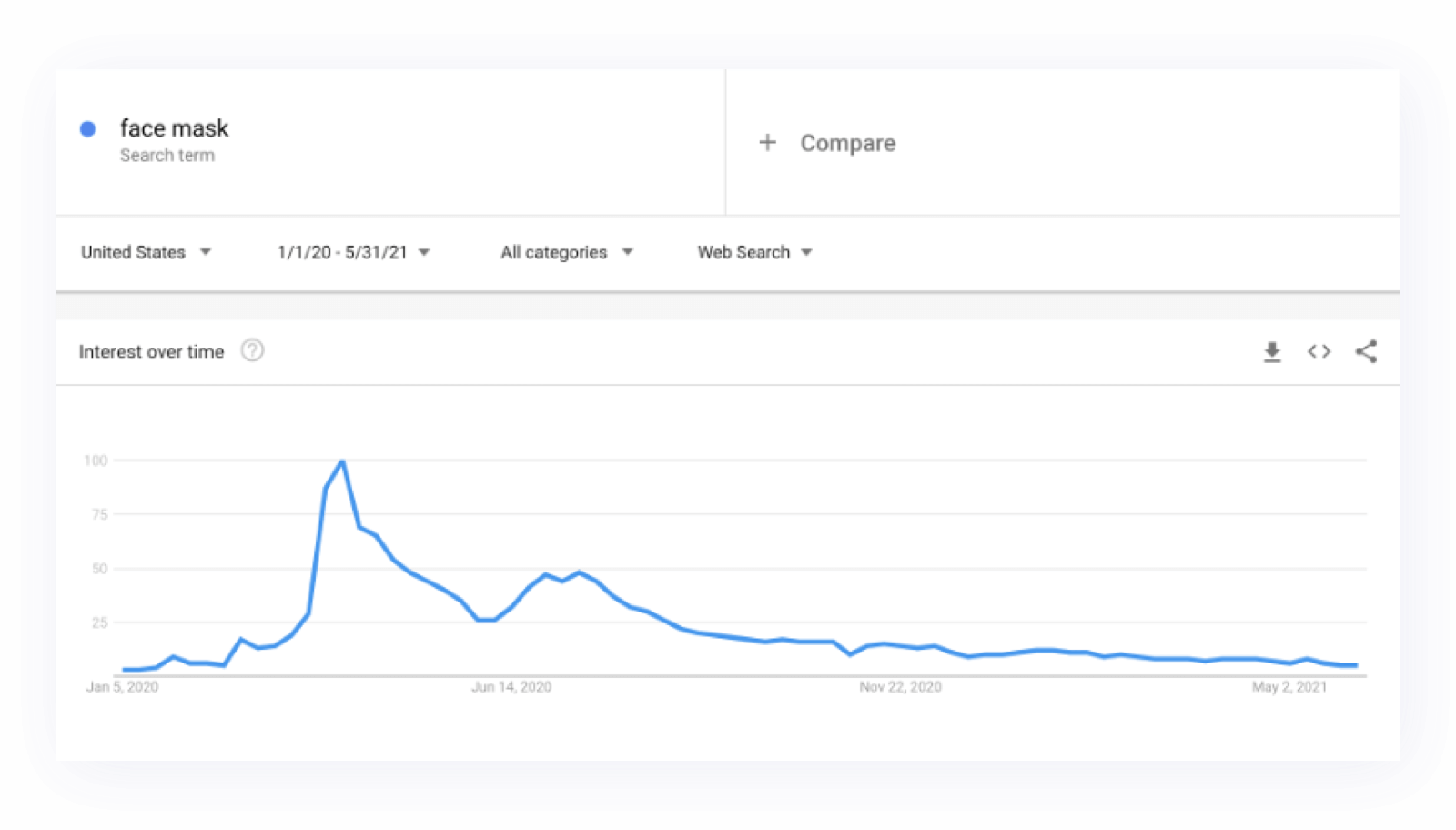

Face masks hit what we can only hope is the highest search peak they will ever reach in April 2020. Suddenly, everyone needed a mask fast, and they needed more than just a box of disposables to do the job.

Consumers started requesting masks from their favorite brands, and brands responded. Small businesses and makers selling on Etsy sold more than 12 million face masks during April 2020, totaling around $133 million in sales and representing their second largest category of sales for April.

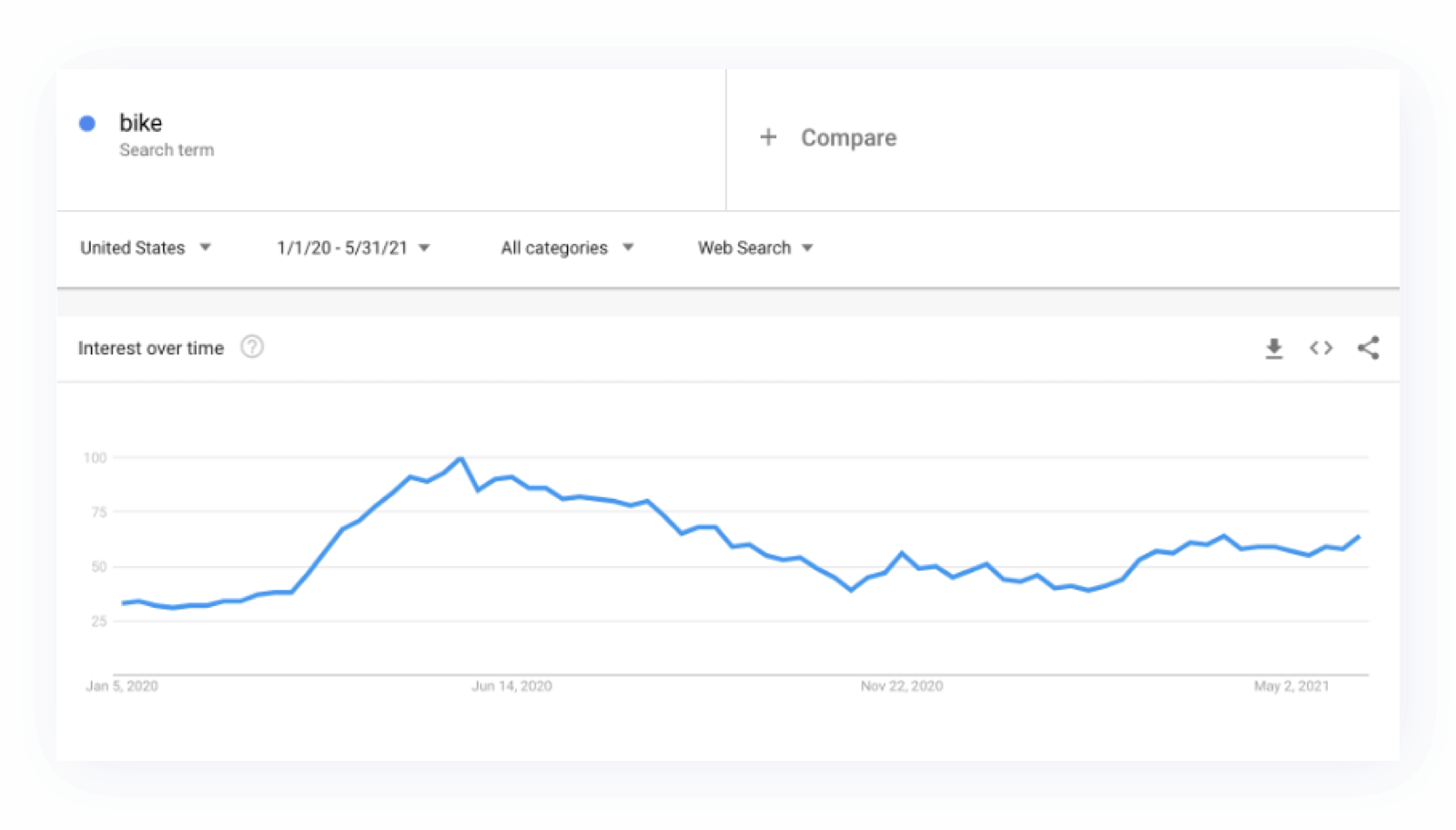

Bikes

Bikes hit a high in May, likely attributed to the new flux of people eager to avoid close quarters on public transportation. Instead, people were opting to bike, both as a main method of easy commuting and an exciting new way to exercise, especially during the summer months.

After a slight dip during the cold months, interest in bikes is rising again, and we’ll likely see another shortage of availability. So, if you’re considering cycling, it’s better to get started now.

In the thick of it

Skincare

Consumers started heavily investing in skincare in June of 2020, likely due to the unfortunate combination of summer heat and a face mask. Navigating a pandemic with a face mask was hard on the skin, especially for essential workers, and consumers doubled down on the products that could combat the mask-induced acne (better known as “maskne”) that was starting to make an appearance.

Desks

Searching for “desks” shot up in August, likely as people realized that work from home was here for the long run. Many companies provided stipends to assist their staff in setting up a home office, and a desk was the first item on many lists.

As the pandemic wanes, many companies are still unsure how to define “back to work.” Maybe that at-home desk will remain the primary one. To be continued…

Nintendo Switches

After a massive spike toward Nintendo Switch in March 2020, another pre-holiday spike occurred in November 2020. The widespread popularity of Animal Crossing, a game many consumers used to socialize with friends in a virtual world, led to a massive uptick in console sales.

Nintendo reported an 82% increase in operating profits year over year; Nintendo sold 28.8 million Nintendo Switch consoles throughout 2020. And, Animal Crossing contributed “significantly to the overall growth in software sales” and drove hardware sales, according to Nintendo.

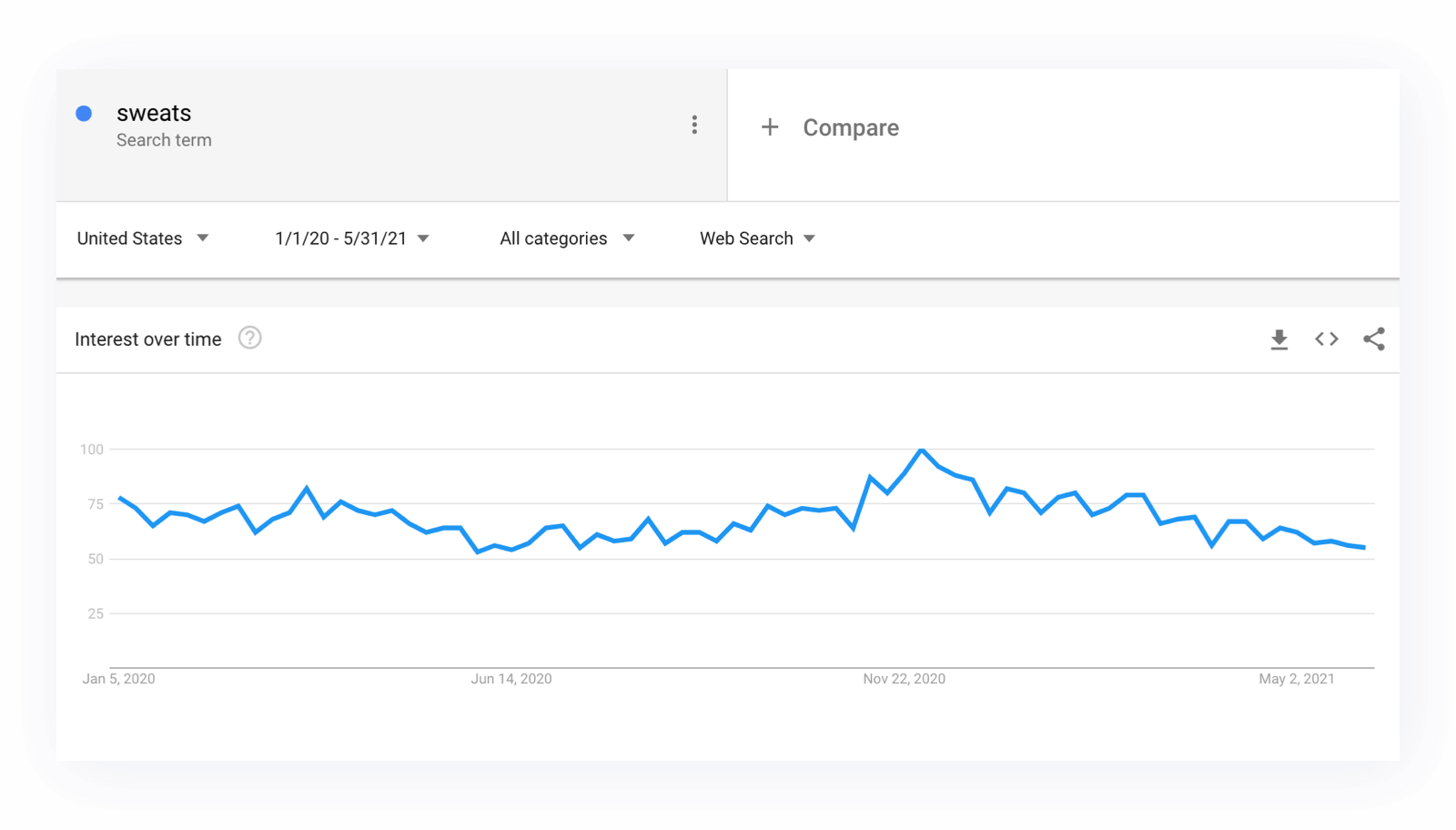

Sweats

Sweatshirts and sweatpants were consistently searched throughout the pandemic, with various upticks as the year progressed. From the viral Entireworld sweatpant set, to real clothing marketed as loungewear, like Hill House Home’s Nap Dress, consumers put the jeans away and prioritized stylish comfort while spending all their time at home.

As shoppers start going out again, they’ll maintain that desire to stay comfortable, but they’ll move away from their beloved sweatpants. “We don’t expect a 180-degree shift into formal clothing,” UBS retail analyst Jay Sole said in a recent note to clients. “Denim is a perfect way for consumers to move away from items such as jogging pants into something that feels more put together, yet still comfortable.”

Knitting supplies

Did you suddenly start receiving scarves, headbands, and sweaters from more than just your grandmother? Maybe your friends, too? The pandemic caused a marked rise in solo activities that could be done at home, and knitting became a newfound hobby for people of all ages, especially during the colder months. Related queries, like “nifty knitting” and “modern daily knitting” also saw a boost.

The beginning of the decline

Pants, dresses, and Botox — oh my!

As vaccines start becoming more readily available, brands are seeing increases in products that make them feel happy and ready to go out. Like what? Like bright-colored dresses to boost the mood, athleisure to stay comfortable while re-entering the world, and Botox to look and feel your best.

Adventurous consumers are even beginning to make the leap back into “hard pants” — that is, pants with zippers, buttons, and non-elastic waistbands. Is the return to hard pants the beginning of the decline? We can only hope not.

How did your shopping habits change throughout the pandemic? Did your brand experience a spike in certain products? Tag us on LinkedIn or Twitter at @yotpo to share your experiences!