The Nexus of Customer Feedback and Data

Nothing can replace digging directly into shopper sentiment. In this lesson, learn how to combine user data and customer feedback for better insight into your shoppers' needs.

D2C Marketing Course

D2C Marketing Course

Nothing can replace digging directly into shopper sentiment. In this lesson, learn how to combine user data and customer feedback for better insight into your shoppers' needs.

Your information will be treated in accordance with our Privacy Policy

In this lesson, learn how to combine user data and customer feedback for better insight into your shoppers' needs.

While traditionally, brands have had a laser-focus on sales data, our senior management team’s lead objective is actually NPS (the likelihood that a customer will refer you). We want a score that puts us among the elite in our category, so that’s something that we gather regularly.

There’s a lot of variables that can come out in customer feedback because there are so many layers that make up the customer experience: we’re working with many manufacturers from around the world, we have warehouses, we have third-party carriers for differently sized goods, etc. We’re always looking for feedback on how the entire process can be improved. It’s a critical piece to how we work.

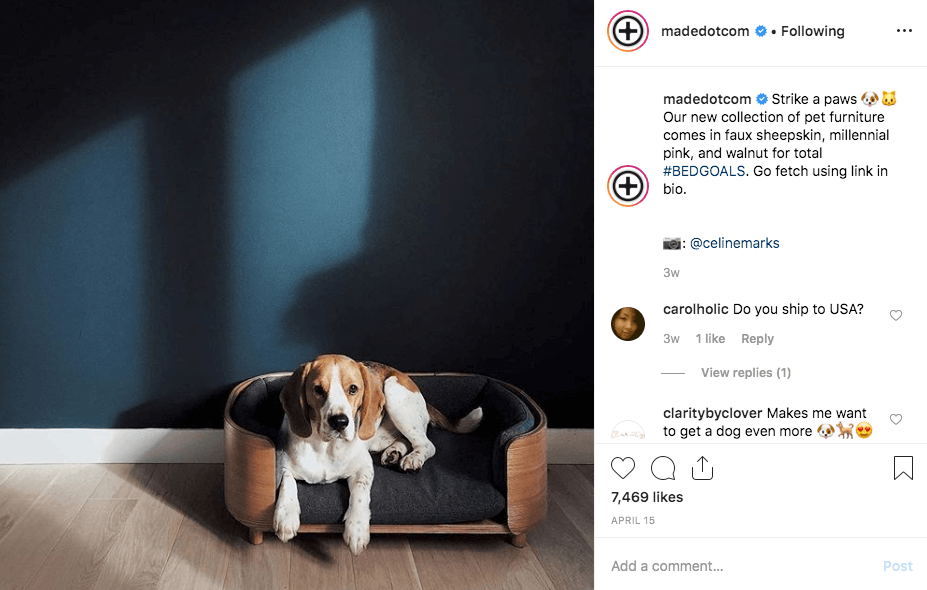

I think one of the unique things about MADE is that we’re fast-furniture in a way. We’re launching hundreds of products a month, but we will also stop selling a product very quickly if it’s not working for whatever reason — either sales or, say, the reviews are really low on it. We’re not a marketplace, so any product that somebody buys from us is MADE branded. Obviously, we want to be known for great designer furniture, great quality, and excellent customer service, so we look to see if that’s all coming out in the reviews themselves.

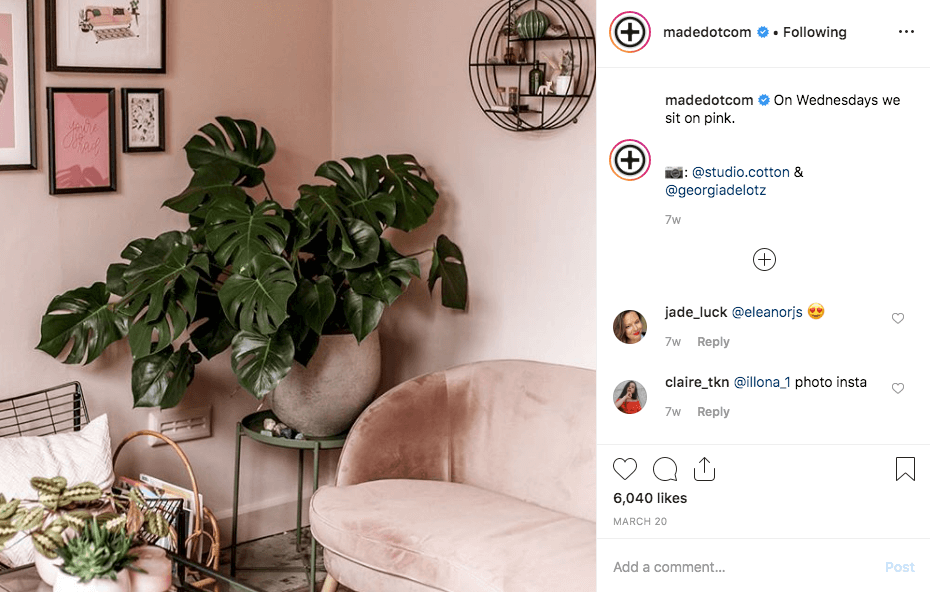

When it comes to thinking about the product range, our buying team is always looking at feedback. We’re typically having to work several months out to get products from design to live on the site. So you have to look at trends quite a bit in advance. You have to look at demand. You have to look at the competition. We look for trends in what we’re hearing from users on particular materials. For example, we haven’t really offered that many leathers, something that we’ve heard that people want. And so there’s a bigger push to add that material now to the product range.

We’ve begun using Yotpo Insights, which uses natural language processing and sentiment analysis, to dig further into our reviews. Insights is useful for aggregating and understanding what’s actually happening in the bigger picture, and funneling the details into different departments as well. Our customer experience team will see what action needs to be taken, and then the product team is looking across different collections and different categories to get a better understanding of if we’re achieving great customer satisfaction across different ranges, especially when we launch a new collection or a new category.

I’m on the team that is in charge of the customer experience with our technology. So that’s our website, our mobile apps, even technology in the showroom. I’ve got quantitative analytics on what people are doing on the site, and we understand our demographics in terms of who our customer base is and where they’re coming from.

When it comes to qualitative metrics, in addition to collecting review feedback, we also try to prototype a lot of the new features that we’re planning for the website, and then we’ll pop over to our showrooms and talk to some users to get feedback. We’ll see if there are any trends in those conversations with users or common themes that come out. Nothing can really replace actually talking to the users and watching them interact with the feature.

The next step is to merge those data sources. With the tools that we have in place, we’ll look at user behavior on the website and try to identify any particular pain points in the journey that line up with what we got out of the user interviews.

For example, several years ago, when we started, our range of products was much smaller. So we had a feature that would take you to the cart quickly, so you could go and check out. But now because our range has expanded a lot more, we don’t want to force you down that funnel right away. Most stores will keep you on the product page even after you add to cart so you can continue shopping. We hear feedback about these flows from our users, we test them, and we look at the data on-site and consider changes we can make.

One of the things that comes up when you start digging into negative reviews or feedback is whether shoppers should be able to see it too. It took us a while to get to a place where we were comfortable showing product reviews on the site at all. I think people wonder, “if I’ve gotten negative reviews, what’s that going to mean?” But the key is that a negative review is not necessarily because the product is bad, rather it didn’t meet the customer’s expectation for whatever reason.

Somebody might give a lower score to a sofa because it’s quite firm, while someone else might expect and even want a firm sofa. So it’s actually perfectly fine and helpful for them to see that in the review. For a first-time customer, this makes sure they’re getting a better experience. In addition to aggregating the feedback from reviews, you have to consider what your shoppers can get out of the feedback and how you can use it to improve their experience.