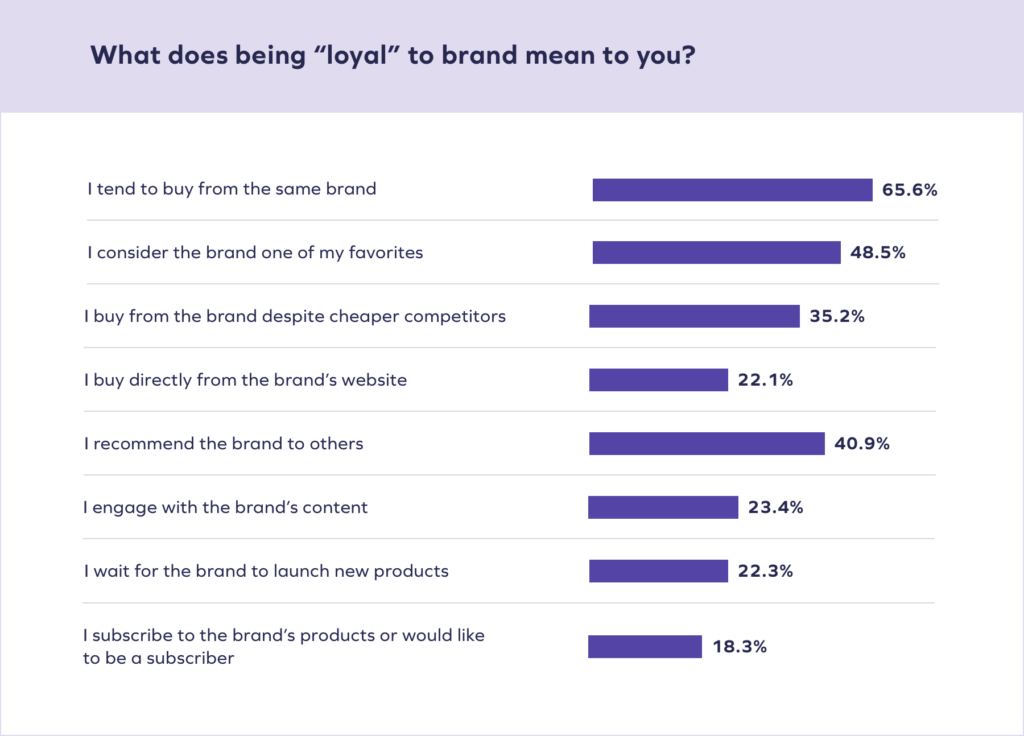

Today, customers expect one-on-one engagement, hyper-relevance, and connection from brands to establish long-term loyalty. We know personalization is an oft-used term in eCommerce, but global survey respondents hammered home how important it remains for customer retention. But even before personalization, brands must understand their customers’ fundamental needs and desires.

Feeling like a brand knows them influences 82.5% of global respondents to buy again from a brand.

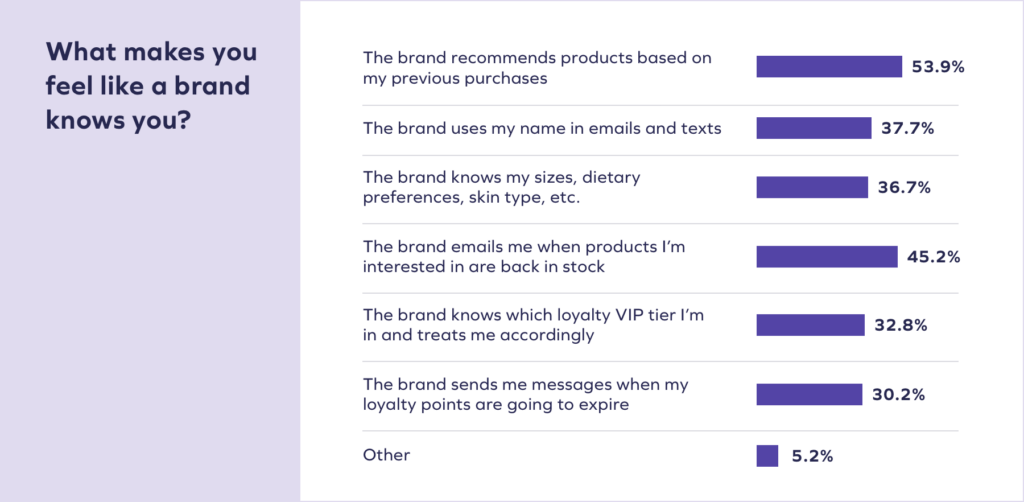

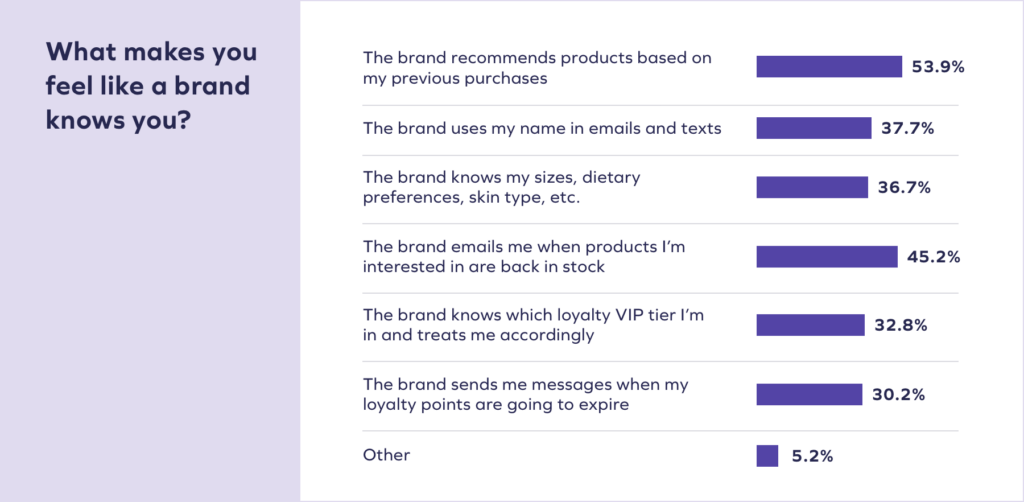

Digging deeper, we asked customers what a brand “knowing” them actually meant. Top responses included:

- The brand recommends products based on previous purchases (53.9%)

- The brand emails a customer when products are back in stock (45.2%)

- The brand uses a customer’s name in emails and texts (37.8%)

These experiences necessitate personalization, yes, but they also require a brand to understand how a customer likes to shop, the products they’re interested in, and what type of communication they prefer. Making good on these expectations requires connected, comprehensive data on your customers, as we’ll discuss in later chapters.

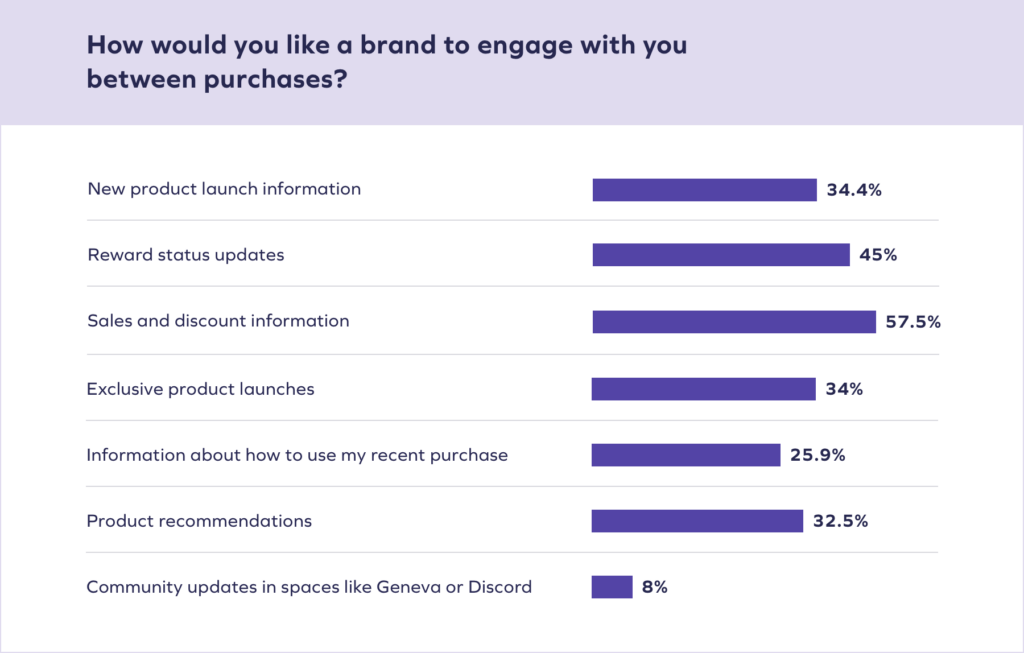

In today’s market, decision fatigue is real, especially as many brands are trying to offload excess inventory and bombard customers with often irrelevant deals and information. Rather than pushing customers toward decision fatigue with a generalized approach, brands must see their customers holistically across channels and touchpoints.

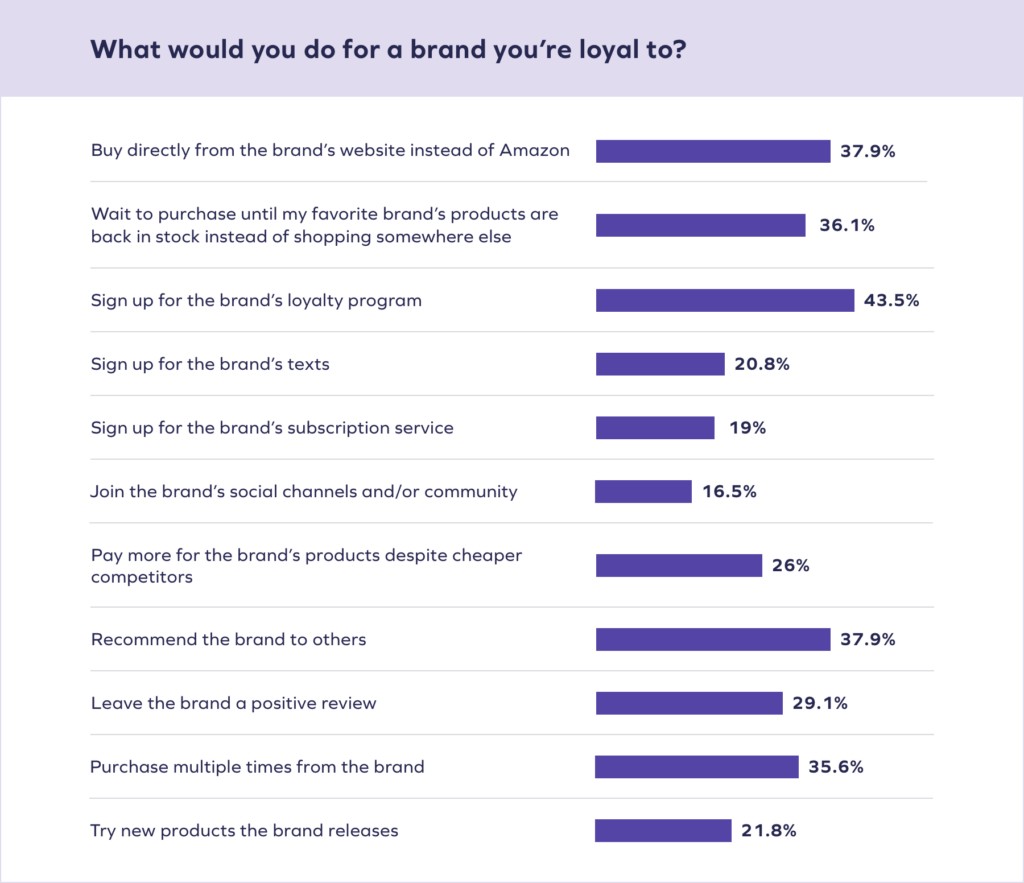

Loyalty programs and the data brands can garner from them offer a solution. Rather than a generalized marketing approach, you can tap into rich customer information and deliver the personalization and relevance that today’s customers crave.

The customer is the customer is the customer — on every channel.

No matter the interaction, time, or transaction, the customer is always the same — and your brand should recognize this. The customer is the same customer when they’re reviewing your products, engaging via SMS, talking to your customer service agents, and redeeming rewards at checkout. Would you want to reintroduce yourself when meeting the same person, time and time again? No, and neither do your customers. The customer is the customer is the customer.

For brands they’re loyal to, customers expect even more. Regarding personal information, customers expect brands to know:

- Their birthday (54.6%)

- Their name (52.7%)

- Their product preferences (48.8%)

Knowing when not to send a message is just as important as when to send a message

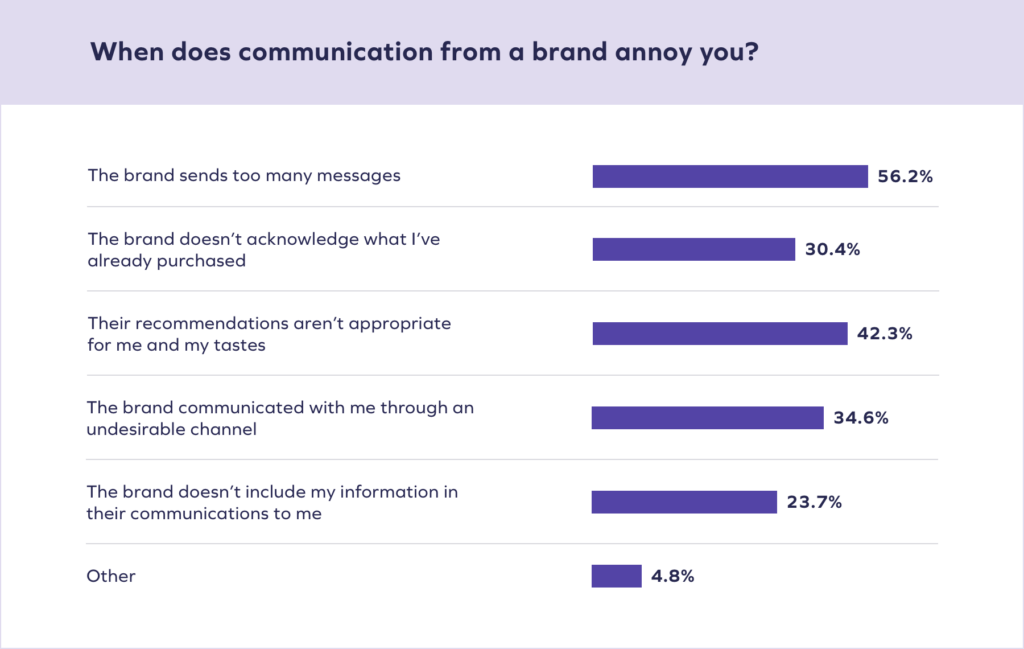

Not only does this recognition affect customers’ outlook on brands but also their behavior. Over 40% of global respondents reported that too many messages or “spam” messages would cause a brand to lose their loyalty. That “spammy” feeling often comes down to irrelevance. A customer can only receive so many text or email blasts before they start to feel a little chagrinned.

Personalization and relevance go hand-in-hand. To keep customers coming back for more, brands have to deliver curated experiences that actually matter to their customers.

It’s not enough to send a text message with a customer’s name attached. Instead, brands must rely on their data to engage customers with the right message at the right time. Communication with customers should often rely on real-time events, like when they abandon their cart, reach a new loyalty tier, celebrate a birthday, or place a high-value order. When the messages you send are linked to specific activities like these, they are more likely to engage your shoppers.

And this all makes sense — over 40% of global respondents associate “Recognition” with the brands they’re loyal to.