As a business owner, you want to make the most of your marketing and sales efforts to grow your customer base. But, have you ever stopped to think about how much it actually costs to acquire each customer?

Understanding your customer acquisition cost (CAC) is crucial for the success of your eCommerce brand. It’s the money you spend to turn a new user into a customer, and it’s a key factor in determining the overall profitability of your business.

So, are you ready to dive into the exciting world of CAC calculation? Don’t worry, it’s not as complicated as it sounds!

In this article, we’ll break down the basics of CAC and show you how to calculate it. By the end of this journey, you’ll have a better understanding of your costs, and you’ll be able to make informed decisions that will help you grow your brand and achieve long-term success!

First, what are customer acquisition costs?

Before we dive deeper into the nitty gritty of CAC, let’s start with a basic definition of the term.

Customer acquisition costs (CAC) is a metric that measures the cost of acquiring a new customer for a business. It is calculated by dividing the total marketing and sales expenses incurred by the number of new customers acquired during a given period of time.

For eCommerce businesses, CAC is an important metric to understand and monitor, as it provides insight into the cost of acquiring new customers through various marketing channels. By monitoring CAC, eCommerce brands can determine the effectiveness of their marketing and sales efforts and make data-driven decisions to optimize their customer acquisition strategies.

Calculating customer acquisition costs

Calculating CAC is a critical aspect of any eCommerce brand’s business strategy, and doing so accurately and efficiently is essential for success. Here are some tips to help eCommerce brands calculate CAC efficiently:

Identify all costs associated with acquiring a customer

This includes advertising expenses, sales salaries, bonuses, and commissions, as well as technology or tools used for sales and marketing.

Use technology to automate cost tracking

There are various tools available that can automate the tracking of costs, making it easier and more efficient to calculate CAC.

Regularly update costs

As costs change, it’s essential to update the information used to calculate CAC to ensure that it remains accurate and relevant.

Track and analyze customer acquisition data

This includes the number of leads generated, the conversion rate of leads to customers, and the lifetime value of a customer. This information can be used to calculate CAC and understand the return on investment (ROI) of marketing and sales efforts.

It is important to analyze the data to determine if it is in line with industry standards and to identify areas where improvements can be made. This analysis should consider factors such as the cost of marketing channels, the cost of customer acquisition by product, and the overall cost of customer acquisition by region.

Use a consistent time frame

To ensure consistency, it’s essential to use the same time frame for calculating CAC, whether it’s monthly, quarterly, or annually.

Regularly recalculate CAC

Regularly recalculating CAC helps eCommerce brands stay up-to-date on their costs and understand the impact of changes to their customer acquisition strategy.

Understanding cost metrics

Cost metrics such as cost per action (CPA), cost per sale (CPS), cost per lead (CPL) and conversion rate (CVR) are all crucial in determining customer acquisition costs. Tracking these metrics, in addition to CAC, provides a more comprehensive understanding of an eCommerce brand’s customer acquisition efforts.

- CPA measures the cost of a specific action, such as a sale or lead, that is taken as a result of a marketing or sales effort. This metric helps eCommerce brands understand the cost of their efforts to drive specific actions and determine the return on investment (ROI) of those efforts.

- CPS measures the cost of making a sale, which is essential in determining the cost-effectiveness of an eCommerce brand’s sales process. By tracking CPS, eCommerce brands can understand the costs associated with converting a lead into a sale and determine the ROI of their sales efforts.

- CPL measures the cost of acquiring a lead, which is a critical metric in determining the cost-effectiveness of an eCommerce brand’s marketing efforts. Tracking CPL helps eCommerce brands understand the cost of generating leads and determine the ROI of their marketing efforts.

- CVR measures the percentage of leads that are successfully converted into sales, which is a critical metric in determining the effectiveness of an eCommerce brand’s sales process. Tracking CVR helps eCommerce brands understand the efficiency of their sales process and make improvements where necessary.

Predicting customer acquisition costs

As every eCommerce marketer knows, it’s important to project how you will grow and what it will cost to do so. And in order to do that, you need to be able to predict your acquisition costs.

Predictive analytics can be a powerful tool for eCommerce brands to determine their CAC and make informed business decisions. Predictive analytics uses data, statistical algorithms, and machine learning techniques to identify patterns and make predictions about future outcomes. In the context of CAC, predictive analytics can be used to forecast future costs, identify trends, and optimize marketing and sales efforts.

Here are some steps eCommerce brands can take to use predictive analytics to determine CAC:

Collect and analyze customer acquisition data

This includes data on advertising expenses, sales salaries, bonuses, and commissions, as well as data on the number of leads generated, conversion rates, and the lifetime value of a customer.

Use statistical algorithms to identify patterns

Predictive analytics algorithms, such as regression analysis and decision trees, can be used to identify patterns and relationships between different variables in the customer acquisition data.

Develop predictive models

Using the patterns identified by the algorithms, eCommerce brands can develop predictive models that forecast future CAC based on historical data and trends.

Use machine learning techniques to optimize predictions

Machine learning techniques, such as neural networks and decision trees, can be used to optimize predictions and improve the accuracy of CAC forecasts.

Integrate predictions into decision-making

Predictive analytics can provide eCommerce brands with valuable insights into future CAC and help inform business decisions, such as optimizing marketing and sales efforts and adjusting budgets.

Benchmarks for CAC by eCommerce vertical

In the eCommerce industry, customer acquisition costs can range from $30 to $150, depending on the product or service being offered. Additionally, CAC can vary by vertical within the eCommerce industry.

Here are some estimated CAC ranges by vertical in the eCommerce industry:

1. Health and Beauty

CAC for health and beauty products can range from $40 to $100.

2. Fashion

CAC for fashion products can range from $30 to $100.

3. Home Goods

CAC for home goods can range from $40 to $100.

4. Electronics

CAC for electronics can range from $50 to $150.

5. Food and Beverage

CAC for food and beverage products can range from $30 to $80.

These ranges are estimates and can vary depending on the specific business, target audience, and marketing efforts.

It is important for eCommerce businesses to regularly monitor and compare their CAC to these industry standards to ensure that they are on track and making the most of their marketing efforts. By understanding and analyzing CAC in the eCommerce industry, businesses can make data-driven decisions to improve their customer acquisition efforts and achieve success.

Evaluating CAC in relation to customer LTV

In addition to understanding and analyzing customer acquisition costs, it is also important to evaluate the costs in relation to the customer lifetime value (CLTV) for your brand. CLTV is a metric that measures the total value a customer will bring to a business over their lifetime as a customer.

Comparing CAC to CLTV provides a clearer picture of the long-term profitability of customer acquisition efforts. If the CLTV of a customer is higher than the CAC, it means that the business is generating a positive return on investment from customer acquisition. On the other hand, if the CLTV is lower than the CAC, it means that the business is losing money on customer acquisition and needs to reassess its strategy.

To accurately compare CAC to CLTV, businesses must calculate both metrics accurately. CLTV can be calculated by multiplying the average purchase value by the number of purchases per year and the average customer lifespan.

By regularly comparing CAC to CLTV, businesses can identify areas where improvements can be made to customer acquisition efforts in order to achieve a positive return on investment and maximize customer lifetime value.

Lowering customer acquisition costs

Once you compare your CAC to your CLTV, you might find that it’s essential to balance the scales and spend less on acquisition. (And of course, reducing CAC is always a goal for eCommerce businesses that are looking to be efficient with their marketing spend.) Here are some tips to lower customer acquisition costs:

Optimize marketing and sales efforts

This can be done by improving website design, using data-driven marketing strategies to target the most profitable customer segments, and regularly evaluating the efficiency of marketing channels.

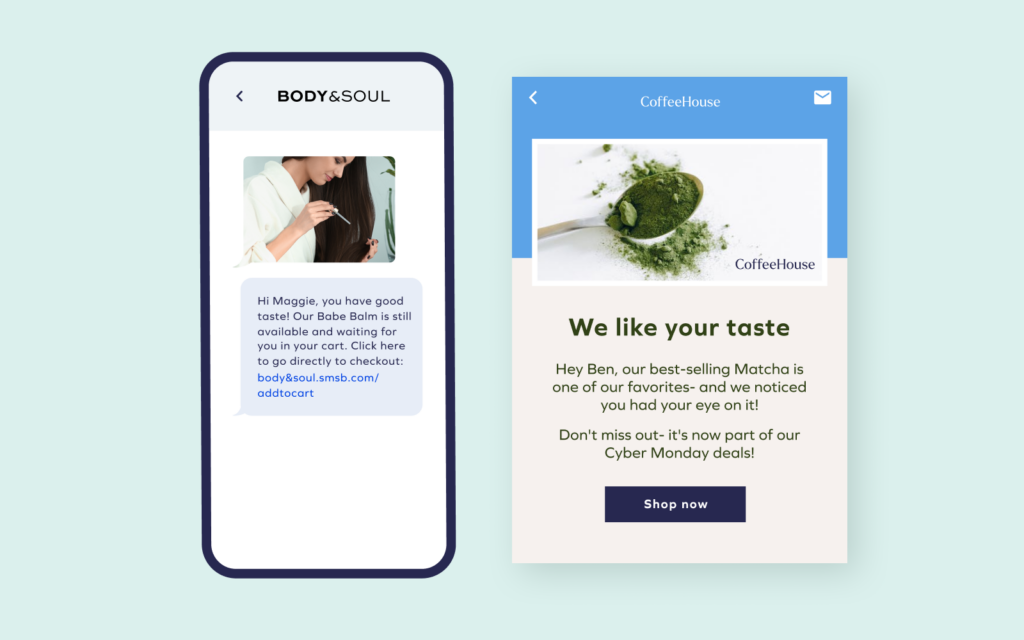

Improve customer conversion rates

This can be achieved by offering compelling promotions, personalizing customer experiences, and providing excellent customer service.

Reduce the cost of marketing channels

Evaluate the cost of each marketing channel and consider reducing the cost of less efficient channels, or increasing the use of cost-effective channels.

Target the most profitable customer segments

Use data to identify the most profitable customer segments and focus marketing efforts on these segments to maximize the return on investment.

Reduce the cost of customer acquisition by region

Evaluate the cost of customer acquisition by region and consider reducing costs in regions where acquisition is more expensive.

Use referral marketing

Encourage existing customers to refer new customers, as referral marketing can be a cost-effective way to acquire new customers.

Leverage automation

Automating marketing and sales processes can reduce costs and improve efficiency.

Ways to boost CLTV to balance high CAC

In some cases, lowering customer acquisition costs may not be a feasible option for eCommerce brands, especially in the current market where CAC is at an all-time high due to paid platforms.

In these instances, optimizing lifetime value can be an effective way to balance high CAC costs. By increasing LTV, eCommerce brands can offset the costs of acquiring new customers and improve their overall business performance.

Here are a few strategies for optimizing LTV to balance high CAC costs:

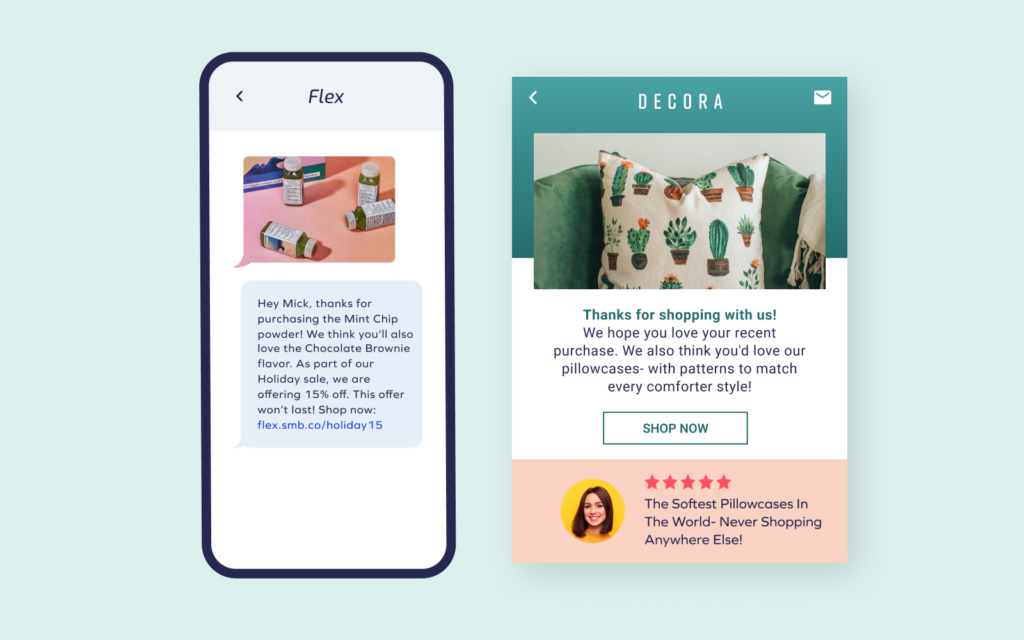

Improve customer retention

By retaining existing customers, eCommerce brands can increase the total amount of revenue they generate from each customer over time. This can be achieved through a variety of methods such as offering loyalty programs, personalized experiences, and high-quality customer service.

For more detailed strategies to boost retention, read our article here.

Upsell and cross-sell

Encouraging customers to purchase complementary or higher-priced products can increase the average transaction value and overall LTV for each customer.

Increase customer frequency

Encouraging customers to make repeat purchases through targeted marketing and promotions can increase the overall LTV for each customer.

By implementing these strategies, eCommerce brands can boost their LTV and offset the costs of acquiring new customers.

The bottom line is this…

Customer acquisition costs are a critical metric for eCommerce brands, and it is important for them to understand and analyze the costs in order to make informed decisions about their marketing and sales strategies.

By reducing customer acquisition costs, businesses can improve their bottom line, increase customer acquisition and growth, and ultimately achieve success.

Curious to learn more? Talk to one of our experts today!

Customer acquisition costs FAQs

What is customer acquisition cost (CAC)?

Customer acquisition cost (CAC) is a metric that measures the cost of acquiring a new customer for a business. It represents the total amount of money spent on marketing and sales efforts to convert a new user into a paying customer. CAC is calculated by dividing the total marketing and sales expenses incurred during a specific period by the number of new customers acquired in that same period. CAC is a crucial metric for eCommerce businesses as it helps them understand the efficiency of their customer acquisition strategies and overall profitability.

Why is calculating CAC important for eCommerce businesses?

Calculating CAC is important for eCommerce businesses because it provides valuable insights into the cost-effectiveness of their marketing and sales efforts. By understanding the cost required to acquire new customers, eCommerce brands can make data-driven decisions to optimize their strategies and improve their return on investment. Monitoring CAC helps businesses identify which marketing channels and campaigns are most effective, allocate resources efficiently, and work towards achieving long-term success and growth.

How do I calculate customer acquisition cost?

The formula to calculate customer acquisition cost (CAC) is relatively simple:

Total Marketing Expenses ÷ Number of New Customers Acquired = CAC

For example, if an eCommerce business spends $10,000 on marketing and acquires 200 new customers in a given period, the CAC would be:

$10,000 ÷ 200 = $50

So, the CAC for acquiring each new customer would be $50.